Smart Rules

In this article, you will learn to configure a smart rules to block any transactions that exceed the set amount or number of transactions.

When perpetrators gain access to cards and OTP or UPI details, they attempt to execute numerous transactions rapidly. Smart Rules offers a solution by allowing you to set restrictions on email address, mobile number, card details, and UPI within a defined time frame, thereby mitigating sudden increases in fraudulent activities. You can create a smart rule to block any transactions that exceed the set:

- Transaction limit

- Amount limit

Create a smart rule

Follow the instructions below to create a smart rule based on transactions:

- Log in to the Payment Gateway dashboard using your credentials.

- Click Riskshield > Smart Rules from the navigation pane on the left.

- From the Smart Limits screen, click + Create a Smart Rule.

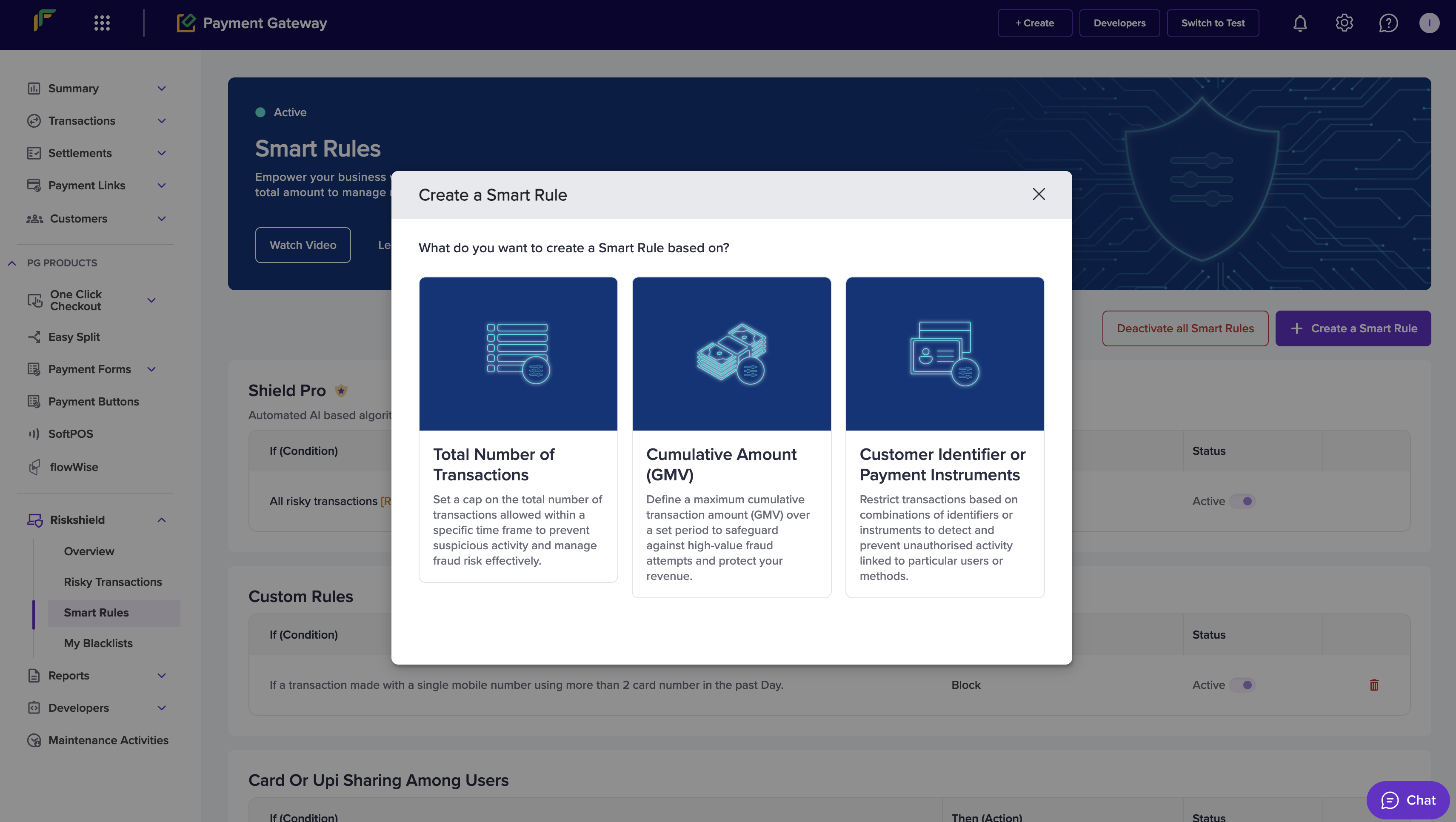

- You can choose to create a smart rule based on the total number of transactions, cumulative amount, or the customer identifier.

Create a Smart Rule

Total number of transactions

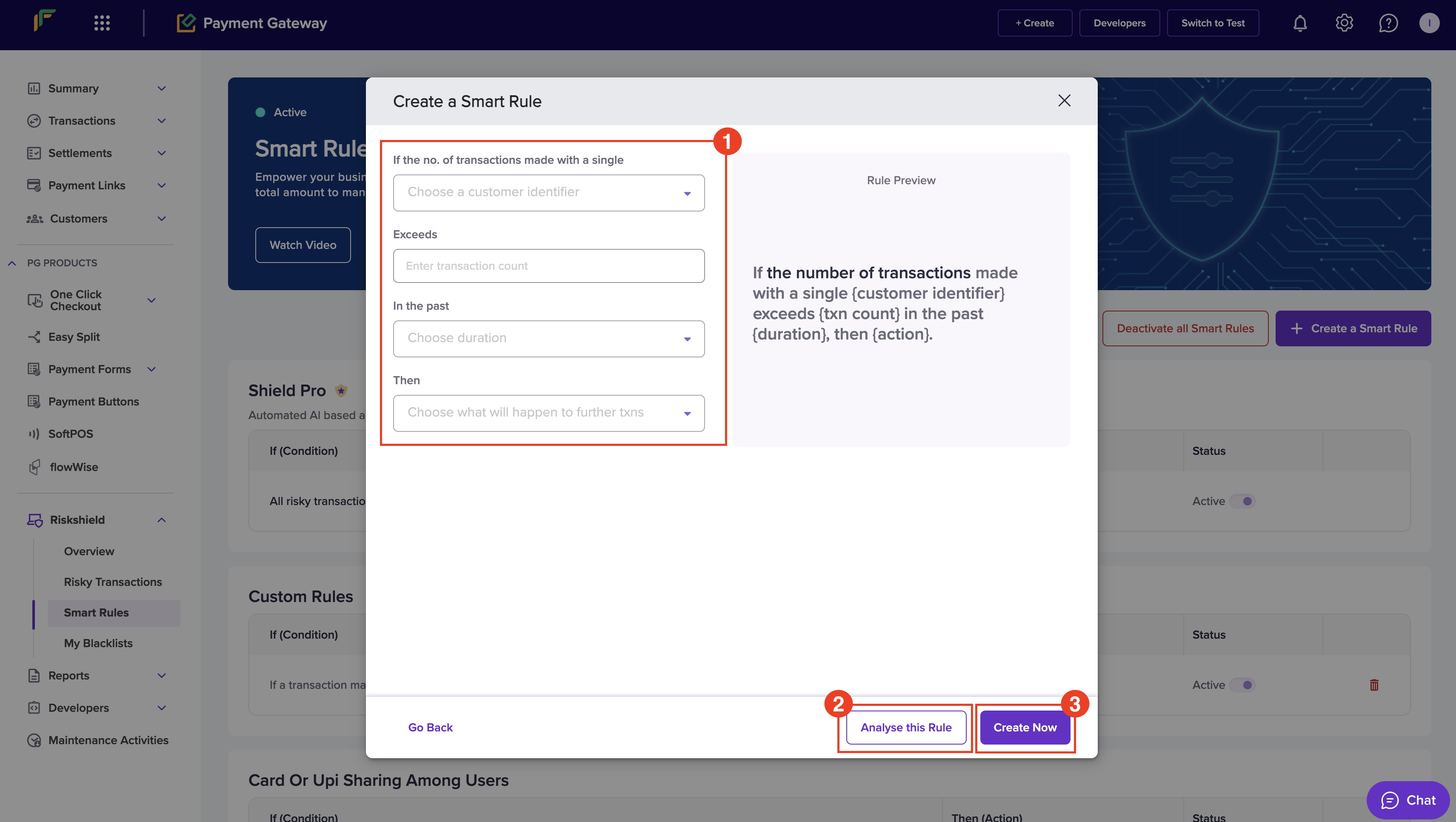

Follow the instructions below to create a smart rule based on the total number of transactions to prevent fraudulent activities:

- In the Create a Smart Rule popup, enter the following information:

- If the no. of transactions made with a single - Use this dropdown to select a unique identifier.

- Add minimum amount per txn - Click this button to enter the minimum amount allowed per transaction. This is an optional field.

- Exceeds - Enter the transaction count in this field.

- In the past - Use this dropdown to choose a duration.

- Then - Use this dropdown to choose whether to block or flag the transactions.

- If the no. of transactions made with a single - Use this dropdown to select a unique identifier.

- Click Analyse this Rule to view the preview of the set rule.

- Click Create Now.

Cumulative amount

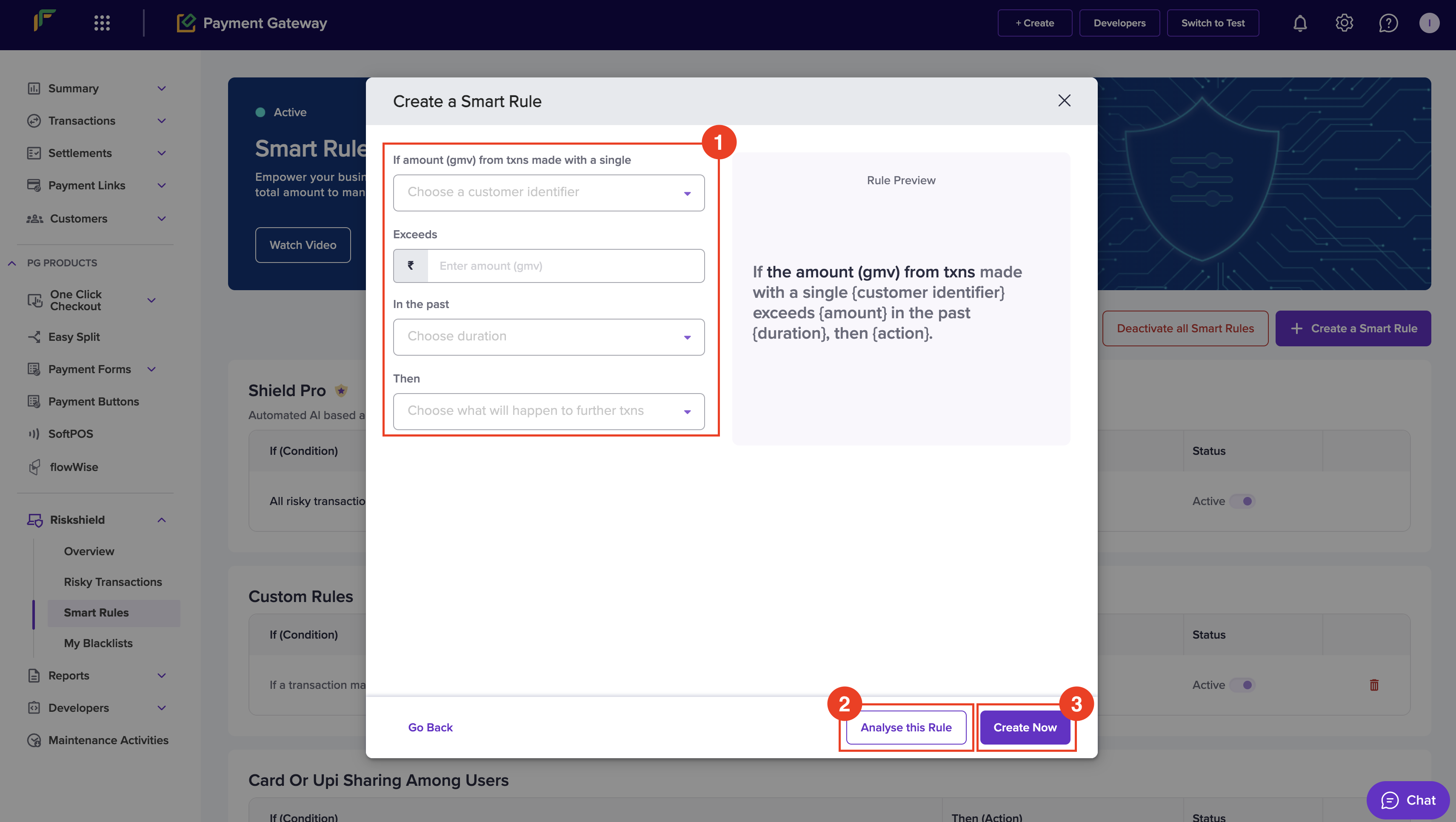

Defining a maximum cumulative transaction amount (Gross Merchandise Value, GMV) over a set period is an effective strategy to mitigate high-value fraud attempts.

- In the Create a Smart Rule popup, enter the following information:

- If amount (gmv) from txns made with a single - Use this dropdown to select a unique identifier.

- Add minimum amount per txn - Click this button to enter the minimum amount allowed per transaction. This is an optional field.

- Exceeds - Enter the amount in this field.

- In the past - Use this dropdown to choose a duration.

- Then - Use this dropdown to choose whether to block or flag the transactions.

- If amount (gmv) from txns made with a single - Use this dropdown to select a unique identifier.

- Click Analyse this Rule to view the preview of the set rule.

- Click Create Now.

Customer identifier or payment instruments

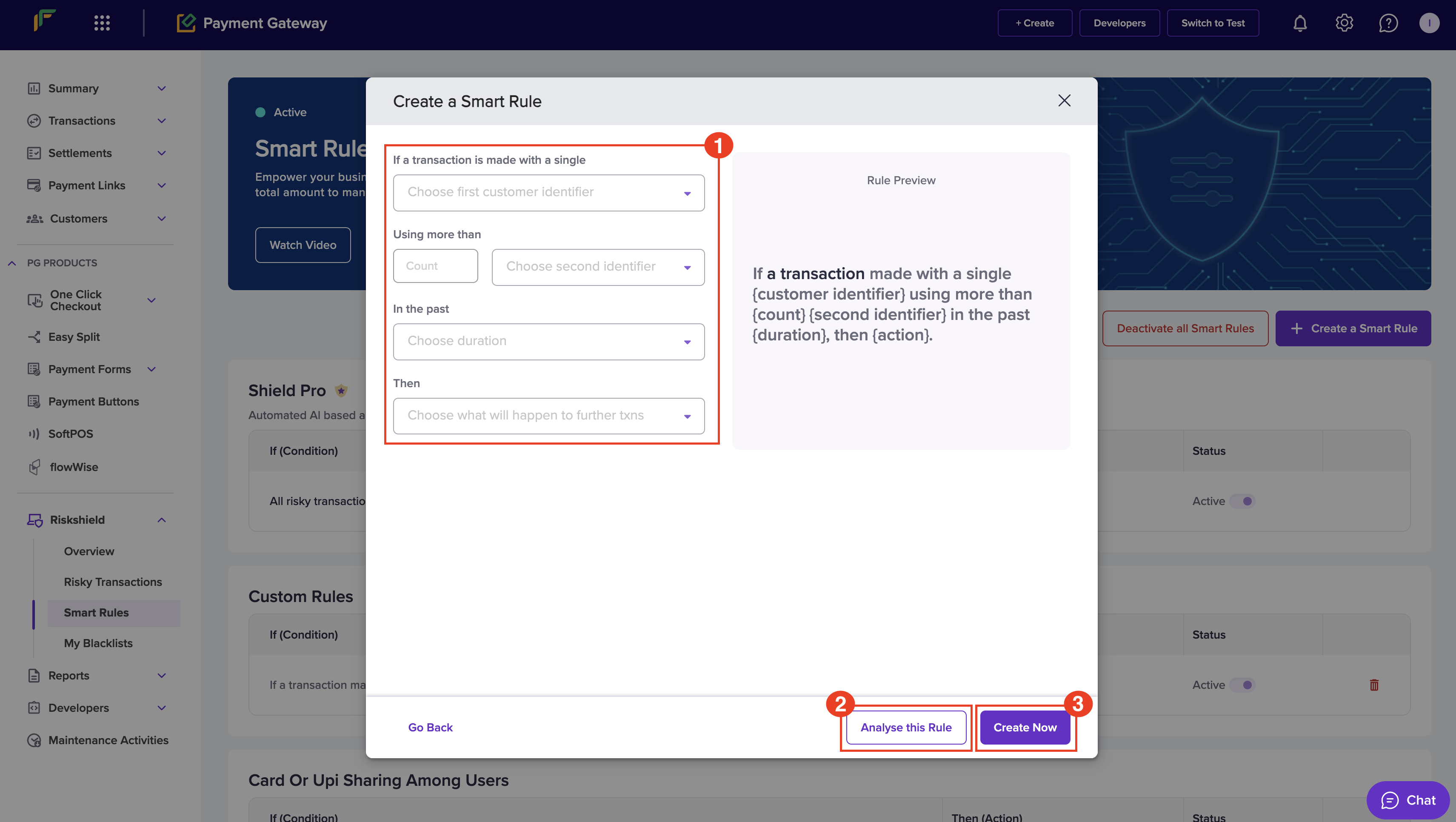

Restricting transactions based on combinations of identifiers or instruments is an effective way to enhance security and prevent unauthorised activities.

- In the Create a Smart Rule popup, enter the following information:

- If a transaction is made with a single - Use this dropdown to select a unique identifier.

- Add minimum amount per txn - Click this button to enter the minimum amount allowed per transaction. This is an optional field.

- Using more than - Enter the count in the Count field, and use the dropdown to select a second identifier.

- In the past - Use this dropdown to choose a duration.

- Then - Use this dropdown to choose whether to block or flag the transactions.

- If a transaction is made with a single - Use this dropdown to select a unique identifier.

- Click Analyse this Rule to view the preview of the set rule.

- Click Create Now.

Duration definition

| Duration | Meaning |

|---|---|

| per 5 minutes | It looks at data for the past five minutes, with the window moving forward every hour to continuously analyse the most recent data. |

| per Hour | It looks at data for the past hour, with the window moving forward every hour to continuously analyse the most recent data. |

| per Day | Till 11:59PM of the current day. |

| for Last 7 Days | Last 6 days + till 11:59PM of the current day. |

| for Last 15 Days | Last 14 days + till 11:59PM of the current day. |

| for Last 30 Days | Last 29 days + till 11:59PM of the current day. |

Recommended rules

Optimise your security strategy with our curated set of rules designed to proactively mitigate risks. These rules are tailored to detect and prevent potential fraud, ensuring robust protection for your business or organisation without compromising user experience.

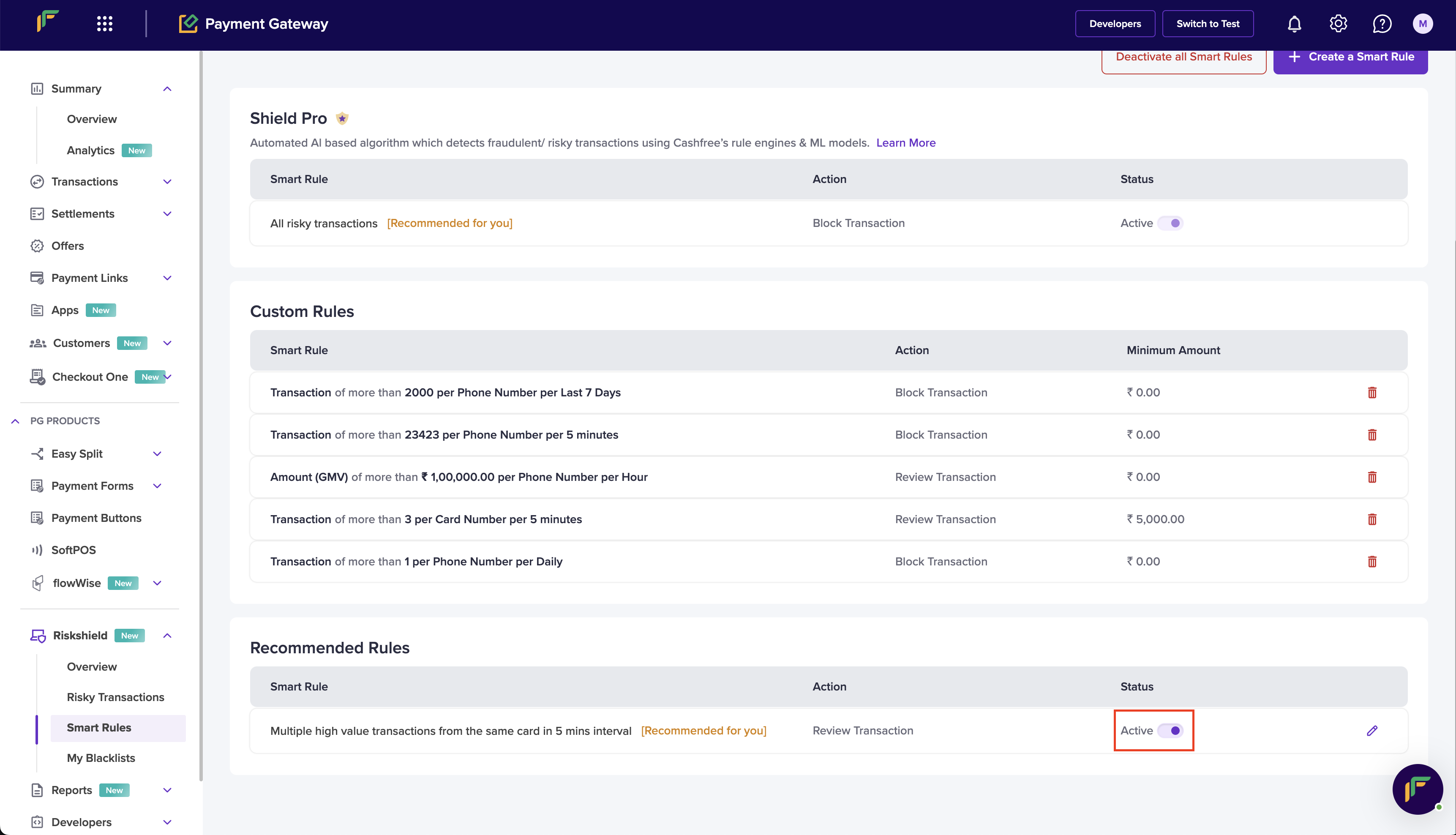

Activate and deactivate a recommended rule

- From the Smart Rules screen, use the toggle under the Status column to activate or deactivate a recommended rule.

The selected smart rule is activated or deactivated accordingly.

Activate / deactivate a recommended rule

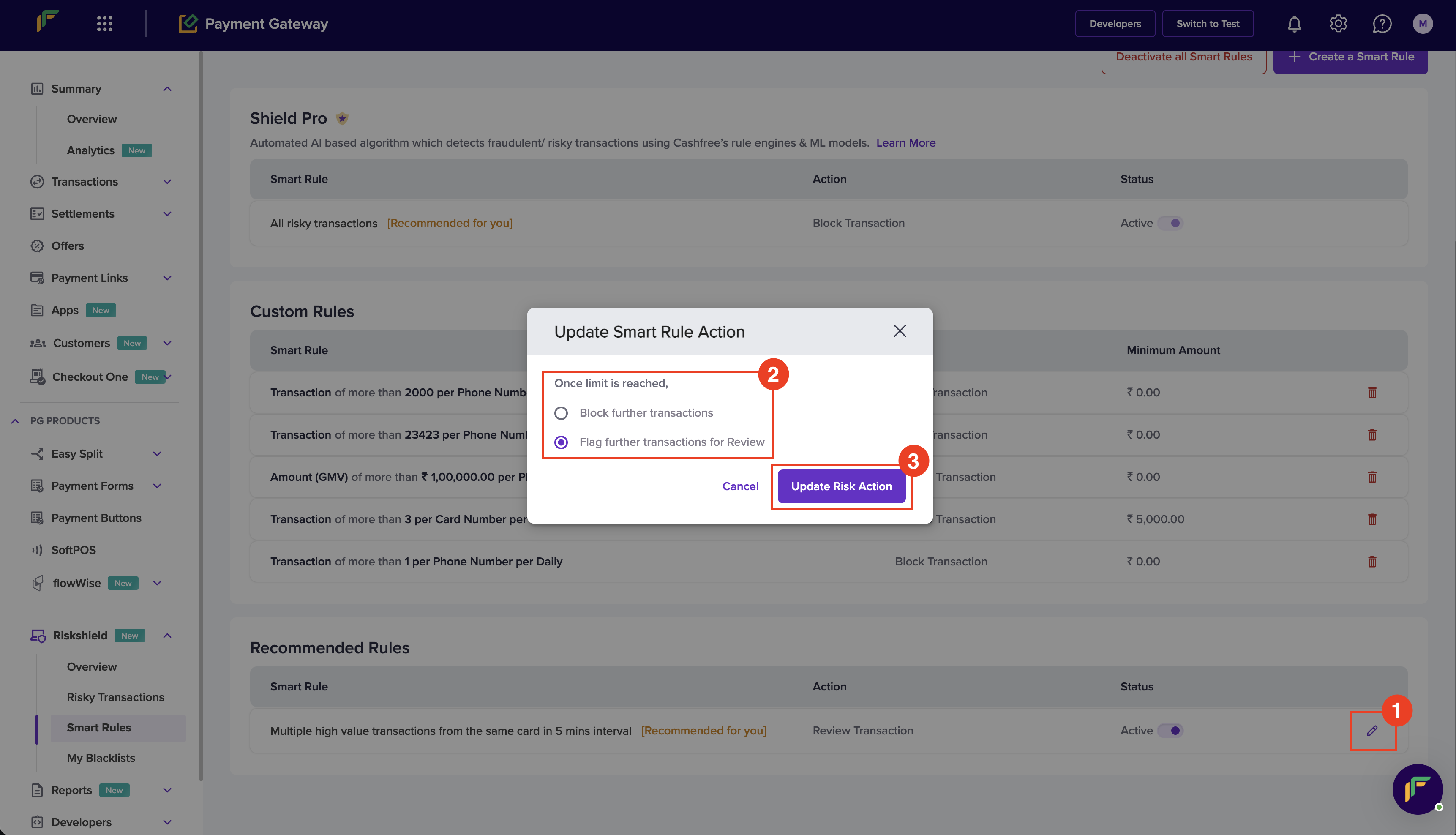

Update smart rule action

You can choose to block or flag the transactions for review that fall under the recommended rule(s).

- From the Smart Rules screen, click the Edit icon under Recommended Rules for the rule you want to update.

- The Update Smart Rule Action popup displays. Use the radio button to choose the following action:

- Block further transactions - Select this option to block the transactions.

- Flag further transactions for Review - Select this option to flag the transactions for review.

- Click Update Risk Action.

Flag transactions from past disputes

This recommended rule is based on the analysis of your past transactions that ended up in disputes and are suspicious.

Update Risk Action

Manage smart rules

Easily modify and delete smart rules ensuring flexible and effective fraud prevention management.

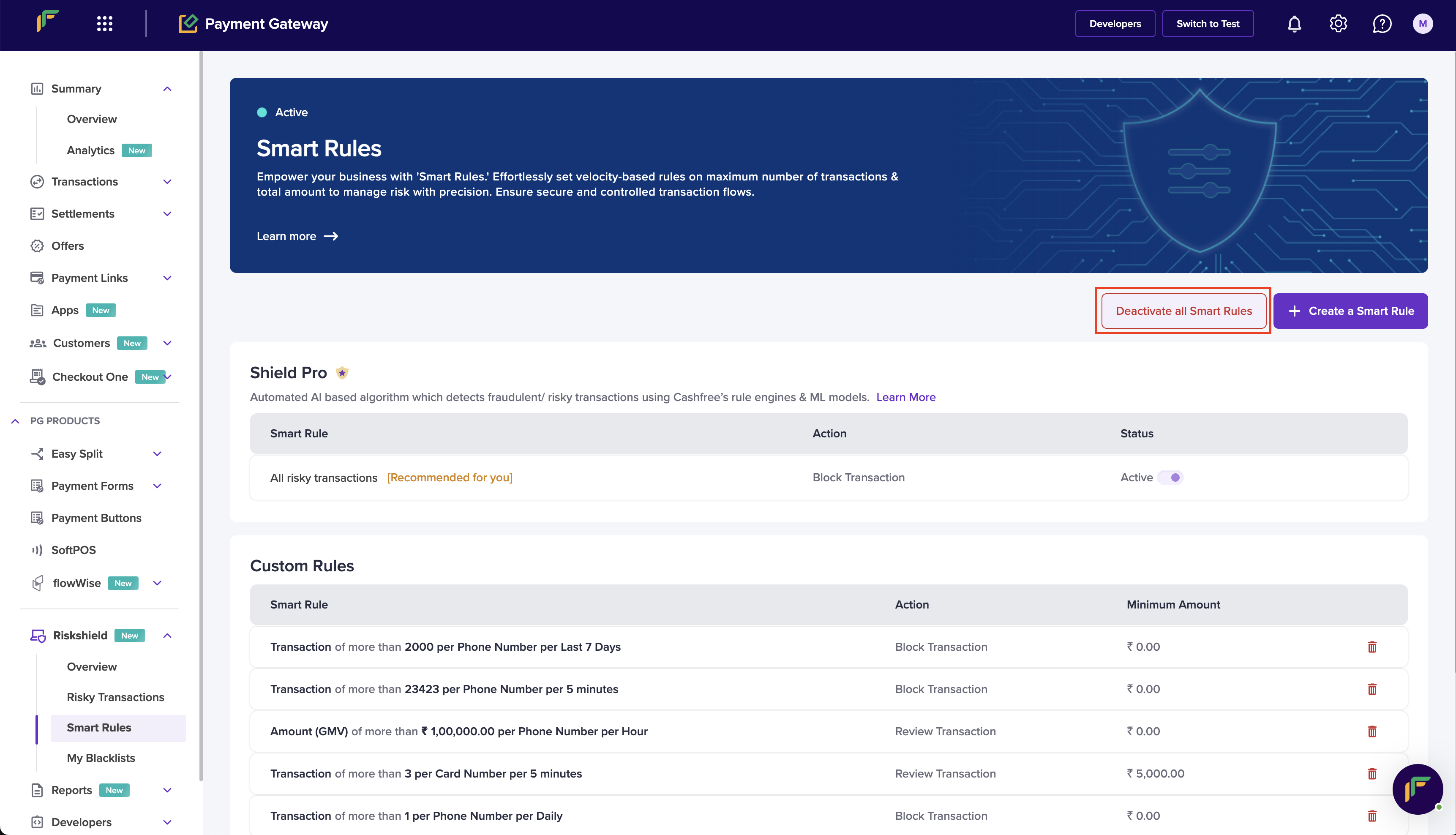

Activate and deactivate all smart rules

Follow the instructions below to activate or deactivate all smart rules:

- From the Smart Rules screen, click Activate all Smart Rules or Deactivate all Smart Rules.

All the smart rules including the recommended rules get activated or deactivated accordingly.

Deactivate all Smart Rules

Shield Pro

Note that you cannot deactivate Shield Pro. It continues to detect fraudulent or risky transactions using the ML model.

Updated about 2 months ago