Risky Transfers

In this article, you will learn about the flagged and blocked transfers.

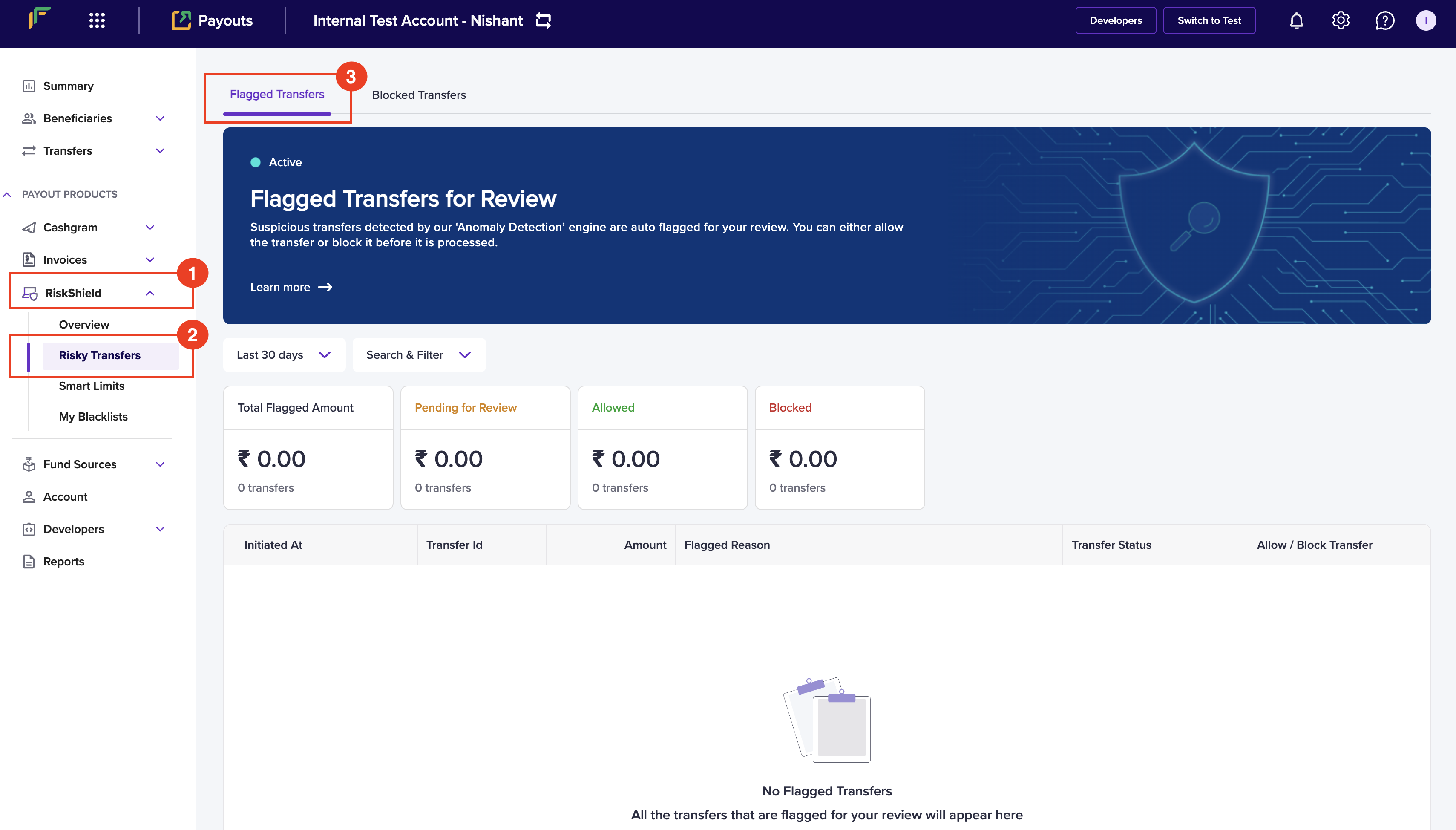

View flagged transfers

We put in the transfers for your review under the Flagged Transfers tab. The idea is for our merchants to review the authenticity of the initiated transfer and decide to approve or reject the transfer.

Follow the instructions below to view the transfers for review:

- Once you log in to the dashboard using your Cashfree Payments credentials, navigate to Risk Shield > Risky Transfers.

- By default, you land on the Flagged Transfers tab.

Flagged Transfers

- Last 30 Days - Use the dropdown menu to select the time period of the blocked transfer that you wish to view. You can click the Calendar icon to select a custom date range.

- Search & Filter - Use the dropdown menu to select the transfer status and click Apply.

- You can find the following information of the flagged transfer:

- Total Flagged Amount - It displays the total flagged transfer amount.

- Pending for Review - It displays the total transfer amount pending for review.

- Allowed - It displays the allowed transfer amount.

- Blocked - It displays the blocked transfer amount.

- You can find the list of transfers in a table with the following information:

- Initiated At - It represents the initiation time of the transfer.

- Transfer Id - It represents the ID of the initiated transfer.

- Amount - It represents the transfer amount.

- Flagged Reason - It represents the reason why the transfer was blocked.

- Transfer Status - It represents the status of the transfer.

You can click a transfer in the grid to drill down and view the complete details of the transfer that is blocked or waiting for approval.

Allow flagged transfers

Once you review the transfers, you can approve the transfer by following the instructions:

- Click the Allow Transfer button against the transfer you wish to approve.

- In the Allow Transfer popup, click Yes, Allow.

Authorisation

You might have to enter an OTP for authorising the transfer if it is a new session.

Allow Transfer

Block flagged transfers

Follow the instructions below to block the flagged transfer:

- Click the Block button against the transfer you wish to block.

- Enter the OTP in the Authenticate popup to and click Confirm.

- In the Block Transfer popup, enter the reason in the Why are you blocking? (Optional) field.

- Click Yes, Block.

Block Transfer

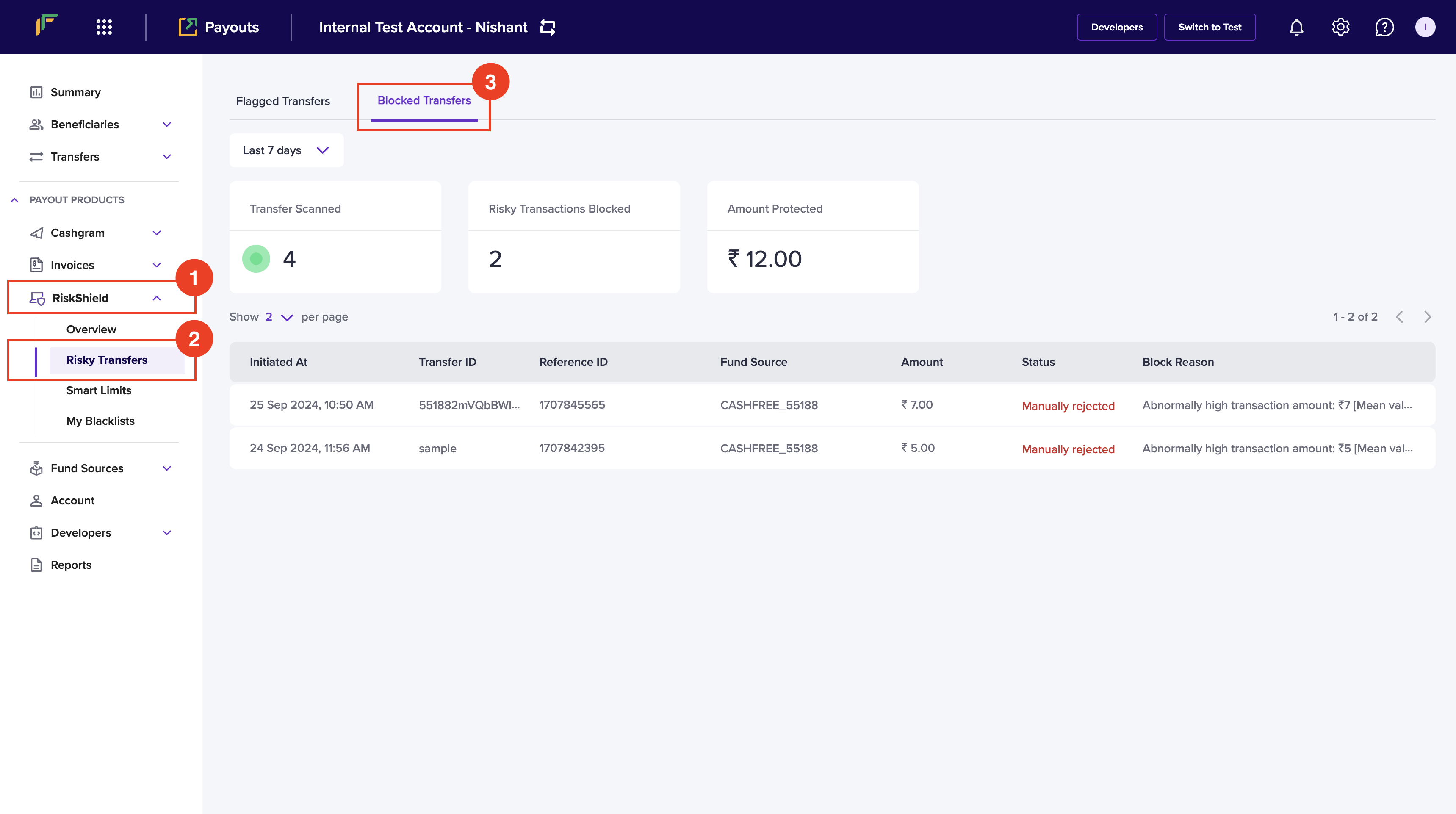

View blocked transfers

A blocked transfer cannot be unblocked. The transfer journey of that specific transfer ends here. The screen gives you the data of the number of transfers scanned, blocked, and the amount protected.

To view the blocked transfers, follow the instructions below:

- Log in to the dashboard using your Payouts credentials and navigate to Risk Shield > Risky Transfers.

- Click Blocked Transfers.

- Last 7 Days - Use the dropdown menu to select the time period of the blocked transfer that you wish to view. You can click the Calendar icon to select a custom date range.

- You can view the following information of a blocked transfer:

- Initiated At - It represents the initiation time of the transfer.

- Transfer ID - It represents the ID of the initiated transfer.

- Beneficiary ID - It represents the ID of the beneficiary designated to receive the transfer amount.

- Fundsource - It represents your fund source account from which the transfer was initiated.

- Amount - It represents the transfer amount.

- Status - It represents the status of the transfer.

- Block Reason - It describes the reason why the transfer was blocked.

Reasons for blocked transfers

Transfers can get blocked for a variety of causes by Risk Shield. It often depends on the transfer type, beneficiary and/or financial institution involved, etc. Here are a few scenarios and reasons for the block.

The table below lists the reasons for a blocked transfer by our Risk Shield:

| Reason | Explanation |

|---|---|

| Bank account blacklisted | If the beneficiary bank account is marked as high risk in our database. |

| High-risk VPA | Some Virtual Payments Address(VPA) of aggregators is highly risky. |

| Email id blacklisted | If the beneficiary email ID is marked as high risk in our database. |

| Mobile no. blacklisted | If the beneficiary mobile number is marked as high risk in our database. |

| VPA Blacklisted | If the beneficiary VPA is marked as high risk in our database. |

The table below lists the reasons for a blocked transfer due to Smart Limits configuration. Smart Limits allow you to control the transfer amount and disable processing transfers at a scheduled time to mitigate any risk.

| Reason | Explanation |

|---|---|

| Exceeded Transfer Limit | The transfer could not be completed as it exceeded the configured maximum transfer amount limit. |

| Exceeded Transfer limit per day | The transfer could not be completed as it exceeded the configured maximum transfer amount limit per day. |

| Exceeded Transfer limit per month | The transfer could not be completed as it exceeded the configured maximum transfer amount limit per month. |

| Exceeded Transfer limit per beneficiary per day | The transfer could not be completed as it exceeded the configured maximum transfer amount limit per beneficiary per day. |

| Exceeded Transfer limit per beneficiary per month | The transfer could not be completed as it exceeded the configured maximum transfer amount limit per beneficiary per month. |

The final table below lists the reasons for a blocked transfer due to My Blacklists. Once a beneficiary is added to the blacklist because you regard them as unacceptable or untrustworthy, we block the transfer that is initiated to prevent the beneficiary from receiving any money.

| Reason | Explanation |

|---|---|

| Blocked list - Bank account | The transfer is blocked because the bank account information of the beneficiary is added in your custom blacklist. |

| Blocked list - VPA | The transfer is blocked because the UPI VPA information of the beneficiary is added in your custom blacklist. |

| Blocked list - Email | The transfer is blocked because the email information of the beneficiary is added in your custom blacklist. |

| Blocked list - Mobile | The transfer is blocked because the mobile information of the beneficiary is added in your custom blacklist. |

Updated 3 months ago