EMI

Learn in detail about EMI and the different EMI types.

EMI helps you provide an instalment capability to your customers at no additional cost. This can be extended over 30+ payment options under cardless, credit card, and debit card.

These payment options are available in the Cashfree Payments checkout page without any additional integration. If you are using a custom checkout page, you can add 25+ EMI options in under 30 lines of code. Refer here for the API documentation.

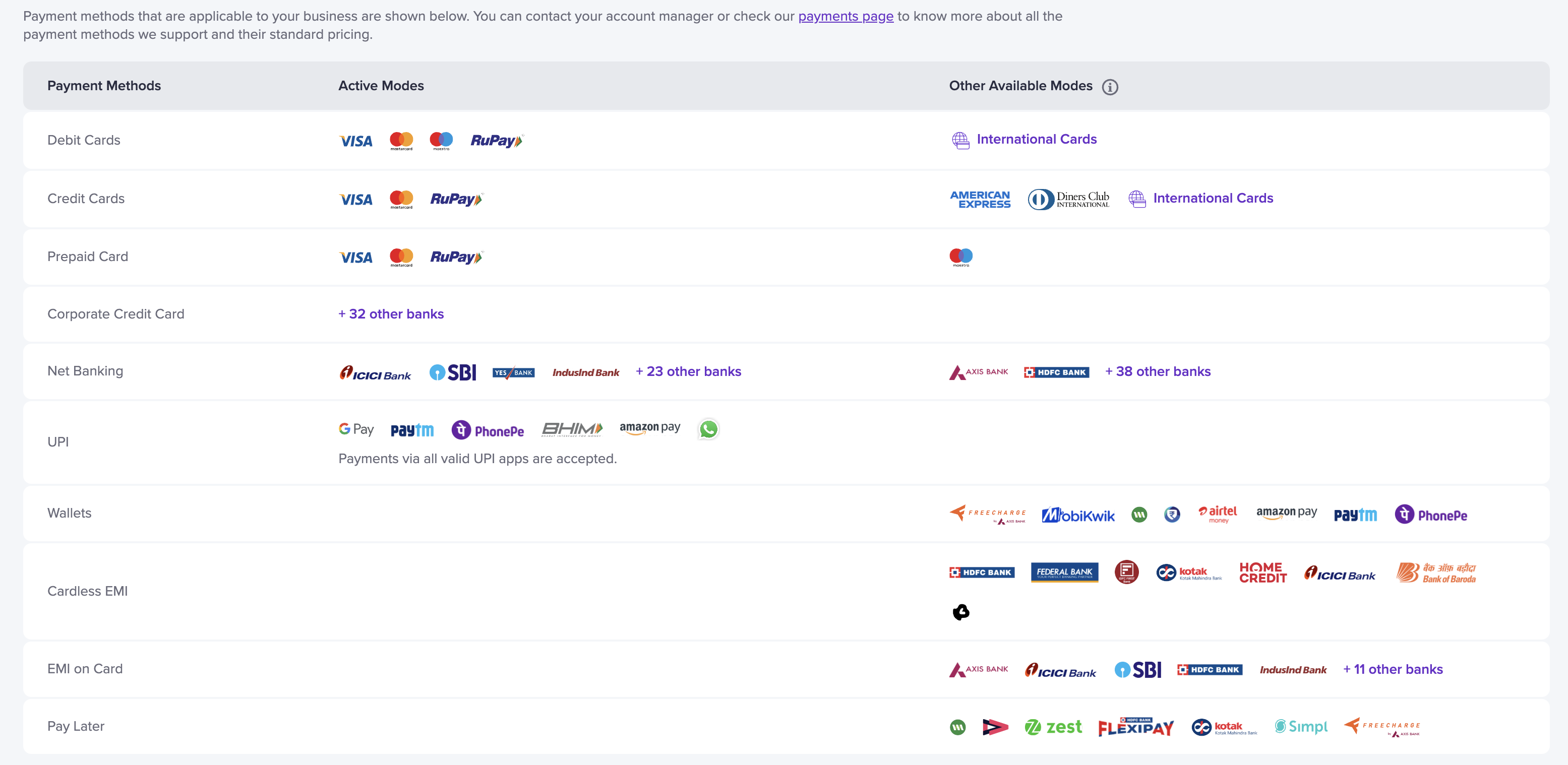

You can view the EMI options activated for your account from Settings > Payment Methods in the Payment Gateway dashboard. Reach out to [email protected] to enable other payment modes. Read more on activating payment methods here.

Payment Methods

EMI Types

The table below lists the EMI payment modes that the customer can utilise to complete the payment on the checkout page.

| EMI Type | Description |

|---|---|

| Credit Card EMI | Cashfree Payments supports Credit Card EMI payment method through which you can reduce the amount the customer pays upfront. Cashfree Payments offers EMI facility on credit cards issued by all major banks. |

| Debit Card EMI | Cashfree Payments supports Debit Card EMI payment method through which you can allow your customers to utilise the benefits of Debit Card EMI plans. EMI on debit cards help you extend EMI capability to non-credit card holders. |

| Cardless EMI | Even if your customers do not possess debit or credit cards they can make use of the EMI benefits by just providing the mobile number. |

| Pay in 3 instalments | A simple pay-in-3 installments option for customers with a credit period of upto 60 days. Zero EMI. |

Credit Card EMI

We offer EMI facility on credit cards issued by all major banks. The tenures supported and the interest charged varies across banks and is listed here. This can be used to populate the EMI plans if you have a custom checkout page.

You can configure No Cost EMI on your own for credit cards and bear the interest charged.

| Issuing Bank | Min Amount | Max Amount | Availability | Credit Period |

|---|---|---|---|---|

| HDFC Bank | 1000 (3 months), 3000 (others) | 500000 | Default | 3-12 months |

| ICICI Bank | 1500 | 500000 | Default | 3-24 months |

| RBL Bank | 1500 | - | Default | 3-24 months |

| Standard Chartered | 2000 | 500000 | Default | 3-12 months |

| Kotak Mahindra | 2500 | - | Default | 3-24 months |

| Bank Of Baroda | 2500 | - | Default | 3-36 months |

| Axis Bank | 2500 | 1000000 | Default | 3-24 months |

| A U Small Bank | 2000 | - | Default | 3-24 months |

| IndusInd Bank | 2000 | - | Requires Approval | 3-12 months |

| Yes Bank | 1500 | - | Default | 3-36 months |

| State Bank of India | 4000 | - | Requires Approval | 3-12 months |

| HSBC Bank | 2000 | - | Requires Approval | 3-24 months |

| Citi Bank | 2500 | - | Requires Approval | 3-12 months |

| Federal Bank | 2500 | 750000 | Requires Approval | 3-12 months |

| American Express | 5000 | - | Requires Approval |

Debit Card EMI

EMI on debit cards help you extend EMI capability to non-credit card holders. We support majority of the top banks that issue debit cards for EMI processing. The tenures and interest rates charged are listed here.

We perform an eligibility check on Cashfree Payments redirection checkout to check if the card-holder is approved for the EMI facility ensuring better conversion.

You can configure No Cost EMI on your own for debit cards and bear the interest charged.

| Issuing Bank | Min Amount | Max Amount | Availability | Credit Period |

|---|---|---|---|---|

| HDFC Bank | 3000 (3 months), 5000 (others) | 500000 | Default | 3-24 months |

| Kotak Bank | 3000 (3 months), 5000 (6 months), 8000 (others) | 100000 | Requires Approval | 3-12 months |

| ICICI Bank | 5000 | 500000 | Default | 3-24 months |

Watch the demo below to understand the Credit and Debit Card EMI payment flow.

Cardless EMI

To help you extend credit at checkout to the maximum number of customers, we have partnered with Banks and NBFCs to provide EMIs using the customer’s mobile number. The customers should be pre-approved by these partners to opt for the EMI facility.

Details on the interest charged across each issuer are available here.

Additionally, you can configure a No Cost EMI for these options and bear the interest charged.

| Issuers | Min Amount | Max Amount | Availability | Credit Period |

|---|---|---|---|---|

| IDFC Bank | 5000 | 100000 | Requires Approval | 3-12 months |

| Kotak Bank | 3000 | - | Requires Approval | 3-12 months |

| HDFC Bank | 3000 (3 months), 5000 (others) | 500000 | Requires Approval | 3-24 months |

| ICICI Bank | 7000 | - | Requires Approval | 3-12 months |

| ZestMoney | 1000 | 150000 | Requires Approval | 3-9 months |

| Cashe | 1000 | 400000 | Requires Approval | 3-12 months |

| TVS Credit | 1000 | 400000 | Requires Approval | 3-12 months |

Watch the demo below to understand the Cardless EMI payment flow.

No Cost EMI

No Cost EMI is an additional feature of EMI, read more on No Cost EMI here.

Pay in 3 instalments

You now have the option to provide your customers a custom Pay-in-3 solution under your unique brand name say for example - Nykaa at zero credit risk. You can launch your own custom branded BNPL option with very limited effort.

Checkout flow -

- Your customer tries to make payment for an order.

- Your customer clicks the Pay in 3 EMI option and their credit eligibility is checked on the fly.

- Your customer enters the OTP and completes their KYC verification.

- Your customer will now pay just 1/3rd of the transaction amount and the transaction is successful. Your customer can repay the next 2 instalments in the subsequent 2 months, at 0% interest.

Subscribe to Developer Updates

Updated 5 months ago