Commissions and Invoices

In this article you will learn in detail about commission and invoices.

Become a Cashfree Affiliate, offer payment solutions to your merchants, and earn a commission for every transaction your customers make. Commission charges are additional fees on the invoice raised by the customer, either as a flat amount or a percentage of the transaction value. You need to create an invoice to receive the earned commission every month.

How does it work?

For Payment Gateway collections: your commission reflects on your affiliate dashboard when a customer makes a transaction on your referred merchant’s website/app and the amount is settled to Cashfree Payments.

Calculate Commissions

Commissions are calculated in two ways:

- Flat rate

- Percentage of the transaction amount

Commission as a flat rate

Flat rate pricing involves charging a fixed rate for a transaction. It does not alter or fluctuate regardless of the transaction amount.

For example, let us say you are an e-commerce automation platform, and you help e-commerce businesses in converting COD orders to pre-paid. You have offered Cashfree's Payment Gateway to one of your clients, ABC Ltd., at a markup of ₹100 over Cashfree’s base rate of 3% (the minimum amount that goes to Cashfree Payments). Here is the calculation for the transaction that ABC Ltd. collected ₹10,000 using Cashfree Payments.

| Transaction Amount (A) | Cashfree's Charge (Base rate) (B) | Your Markup (C) | GST (D) | Total Amount Paid by your Client |

|---|---|---|---|---|

| ₹10,000 | 3% (10,000*3%) = ₹300 | ₹100 | (300+100)*18% = ₹72 | B+C+D = ₹472 |

Commission as a percentage of the transaction amount

Percentage pricing involves charging a specific percentage for a transaction.

For example, let us say you have offered Cashfree’s payment gateway to ABC Ltd. at a markup of 1% instead of INR 100 over Cashfree’s base rate of 3% (the minimum amount that goes to Cashfree Payments).

| Transaction Amount (A) | Cashfree's Charge (Base rate) (B) | Your Markup (C) | GST (D) | Total Amount Paid by your Client |

|---|---|---|---|---|

| ₹10,000 | 3% (10,000*3%) = ₹300 | 1% (10,000*1%) = ₹100 | (300+100)*18% = ₹72 | B+C+D = ₹472 |

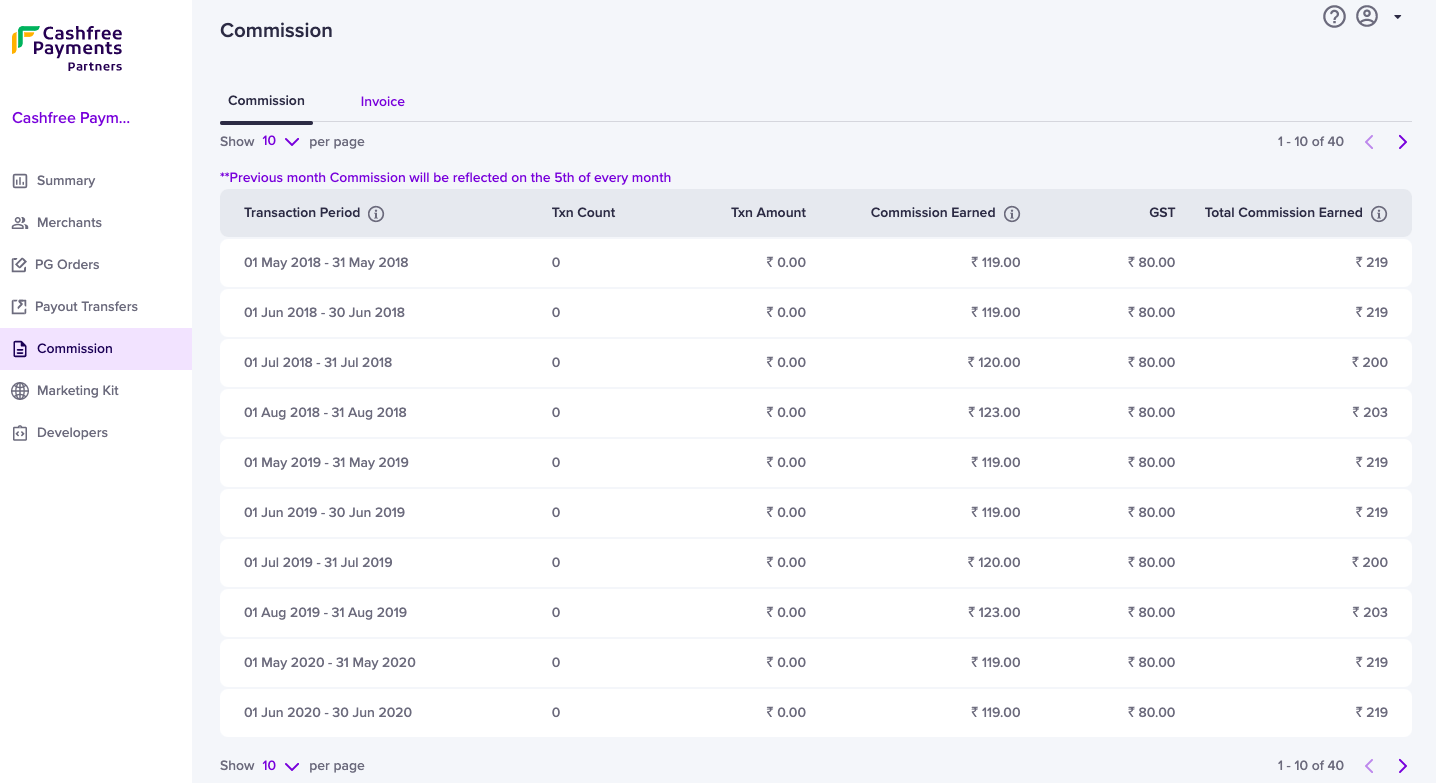

View Commissions

You can track all your commissions from the affiliate dashboard.

- Login to your dashboard using your credentials. Select Commission to view the total commission earned on transactions for a particular period.

View Commissions

- To track payment gateway transactions by your merchants, select PG Orders in the navigation section on the left. You can view the number of transactions, total transaction amount, and commission earned by you on those transactions for every merchant.

- Similarly, go to Payout Transfers to keep track of all transfers made by your merchants using Cashfree Payouts and check the total commission earned on the transactions.

Commission for GST Registered and Unregistered Affiliates

If you are GST registered and shared the GSTIN details with Cashfree Payments, you will see the GST component in the Commission section. This information is not visible to the unregistered affiliates.

All GST-registered affiliates must share their GSTIN with Cashfree Payments as per compliance requirements. Write to [email protected] to update your GST details.

GST Registered Affiliate

Receive Commission Amount

To initiate your commission settlement process for the previous month, you must create an invoice. Click here for more information on how to create an invoice.

Note:

To claim your commission, ensure Affiliate KYC is complete, and the commission structure is configured on your Cashfree Payments Affiliate account. If the commission structure is not configured on your Affiliate account, write to [email protected].

This process is applicable for invoices from September 2022 onwards.

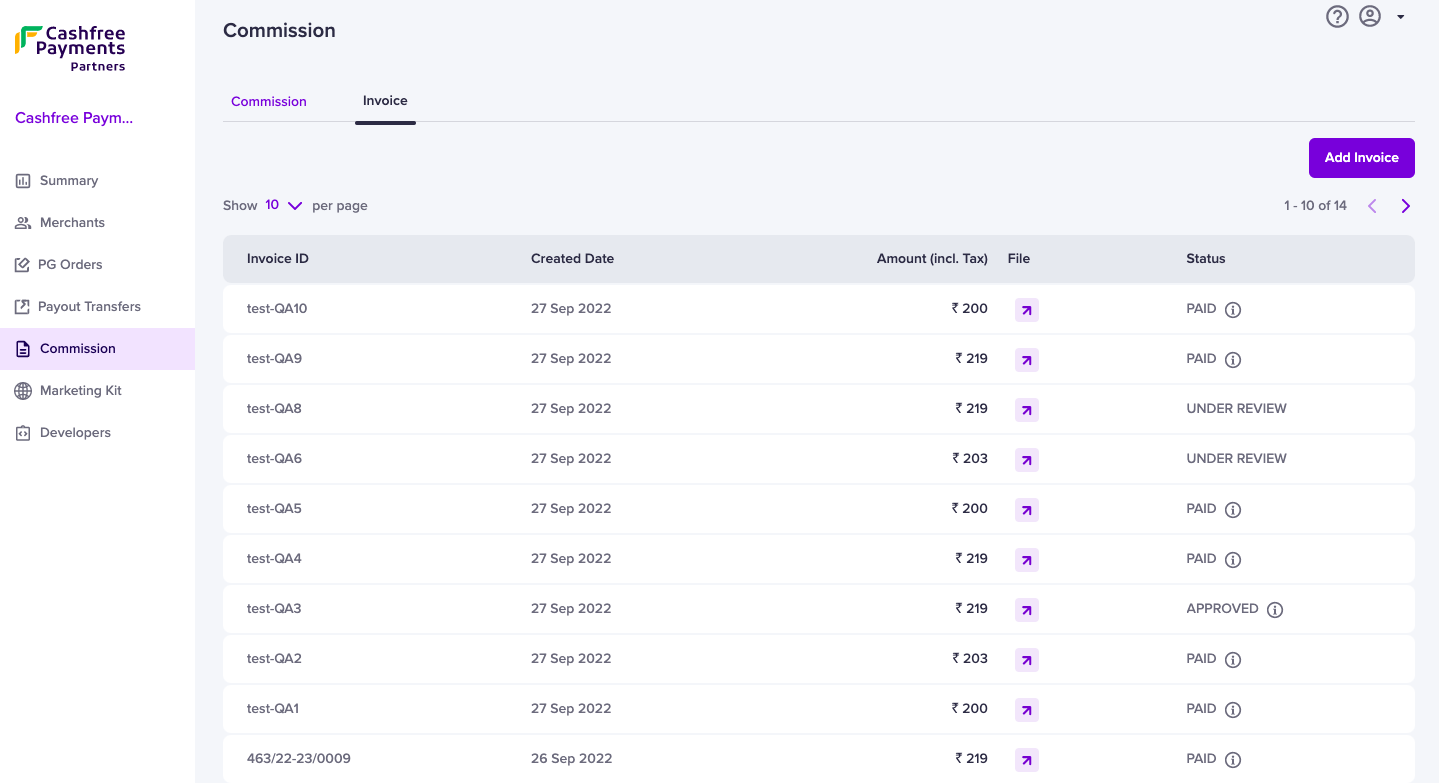

Invoices

To receive the commission amount for the previous months: you must create an invoice, specify the mandatory details, and upload the invoice.

To raise an invoice,

- Login to the affiliate dashboard using your credentials. Select Commission > Invoice.

- Click Add Invoice.

Add Invoice

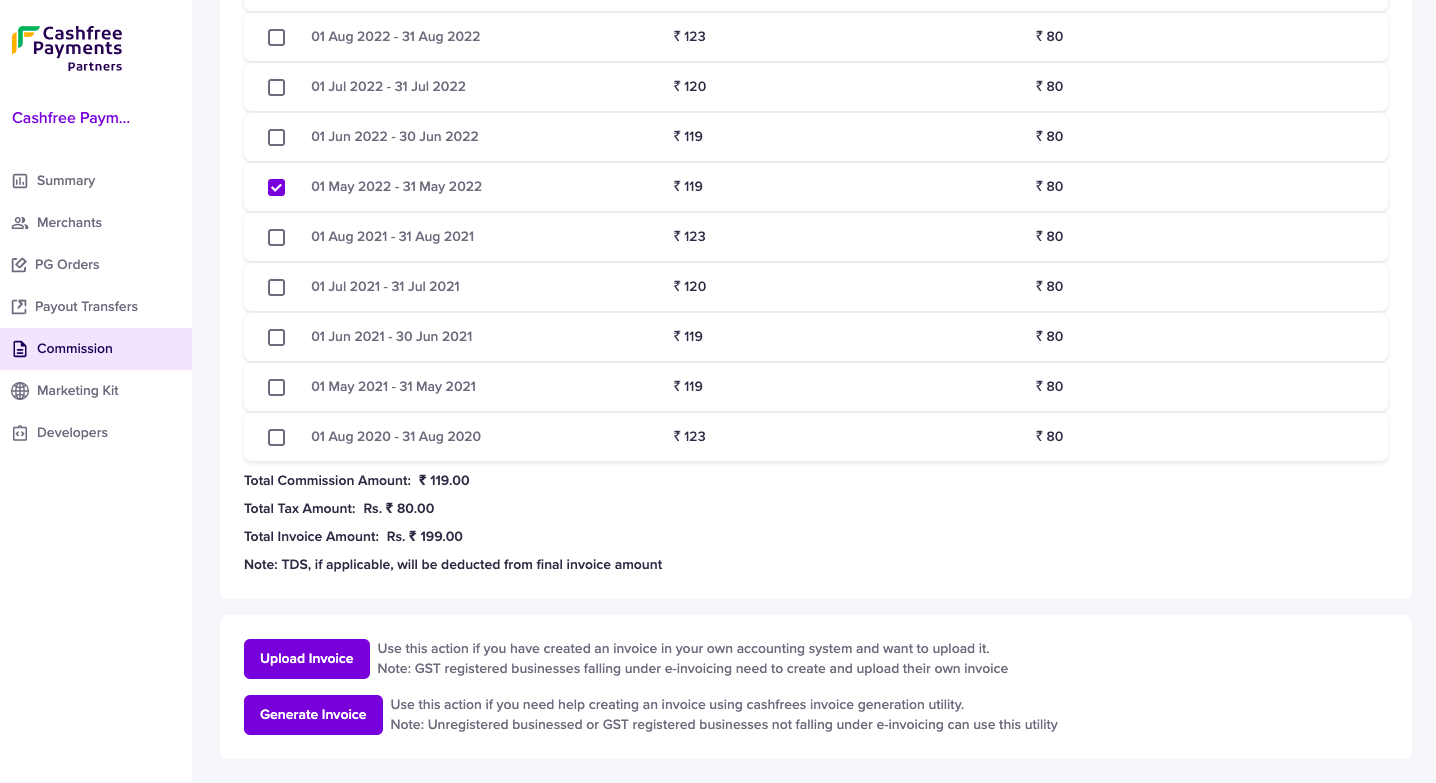

- Select the months for which you want to create an invoice.

- If you use an accounting system and want to upload an invoice using the same system, you can click Upload Invoice. Ensure your company's GSTIN and Cashfree Payments GSTIN are specified in the invoice.

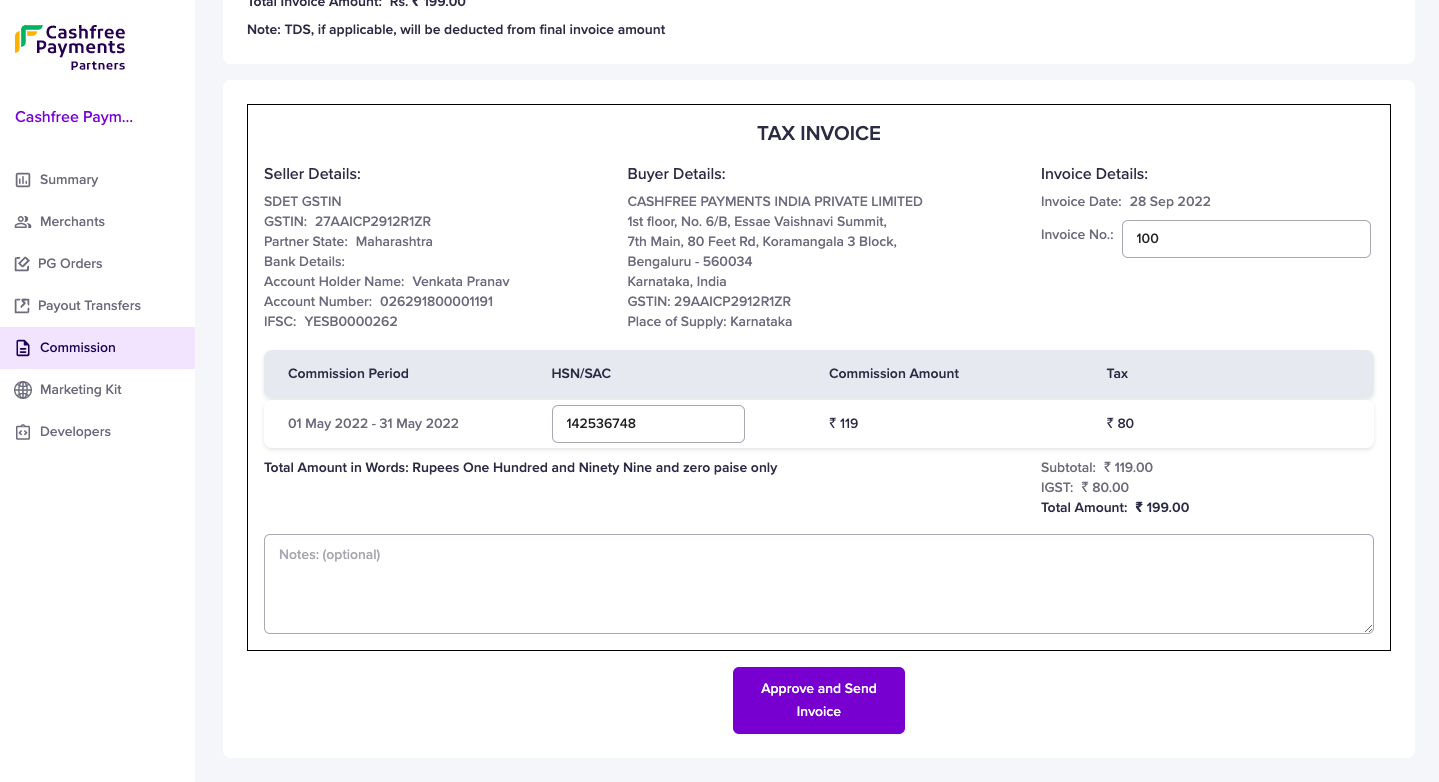

Alternatively, you can click Generate Invoice if you need help with creating the invoice. Cashfree Payments automatically creates an invoice. You can enter the mandatory details and send the invoice.

Upload/Generate Invoice

- Upload or generate the invoice and enter the mandatory details. Click Approve and Send Invoice to send the invoice to Cashfree Payments for further processing of the commission amount.

Approve and Send Invoice

Note:

This process is applicable for invoices from September 2022 onwards. To raise invoices for the previous months, you can follow the steps available here.

Invoice Statuses

| Status | Description |

|---|---|

| Under Review | The invoice status is yet to be verified by Cashfree Payments. |

| Approved | The invoice is verified and approved for processing the commission amount. |

| Payout in Progress | The commission amount is initiated for payout by Cashfree Payments. |

| Paid | The commission amount is settled in your bank account registered with Cashfree Payments. |

| Rejected | The invoice is rejected by Cashfree Payments. |

Updated about 1 year ago