Global Payouts Dashboard

Global Payouts Dashboard helps you with disbursal management. With our powerful and easy to use dashboard, you can effectively operate and manage all your account activities such as payouts, reconciliation, and reversals.

Add Funds

Cashfree Global Payouts - Send Money to India supports Recharge Account functionality to allow disbursal of funds to your beneficiaries in India in a hassle-free manner. Cashfree creates a Recharge Account when you complete the registration process. The account number and swift code for the recharge account will be available in the Bank Account Details section of the dashboard.

With a Recharge Account, you get the flexibility to add funds within the same day and the total available balance in INR is displayed in your Global Payouts dashboard. You need to ensure your account has sufficient funds to continue making payouts seamlessly.

To add funds to your Recharge Account, you need to first add Cashfree as a beneficiary in your registered bank.

- You can add funds from the registered bank account only. Send an email to your Account Manager and provide your bank details.

- As per Reserve Bank of India’s directive, the funds available in your Recharge Account are to be disbursed within a 7-day time period from the date of funds receipt in your account. We will initiate a balance reversal to your registered bank account if the funds do not get disbursed within the defined time period.

- If your banking partner requires details on Nostro account (Intermediary Bank Account Details), contact your Account Manager.

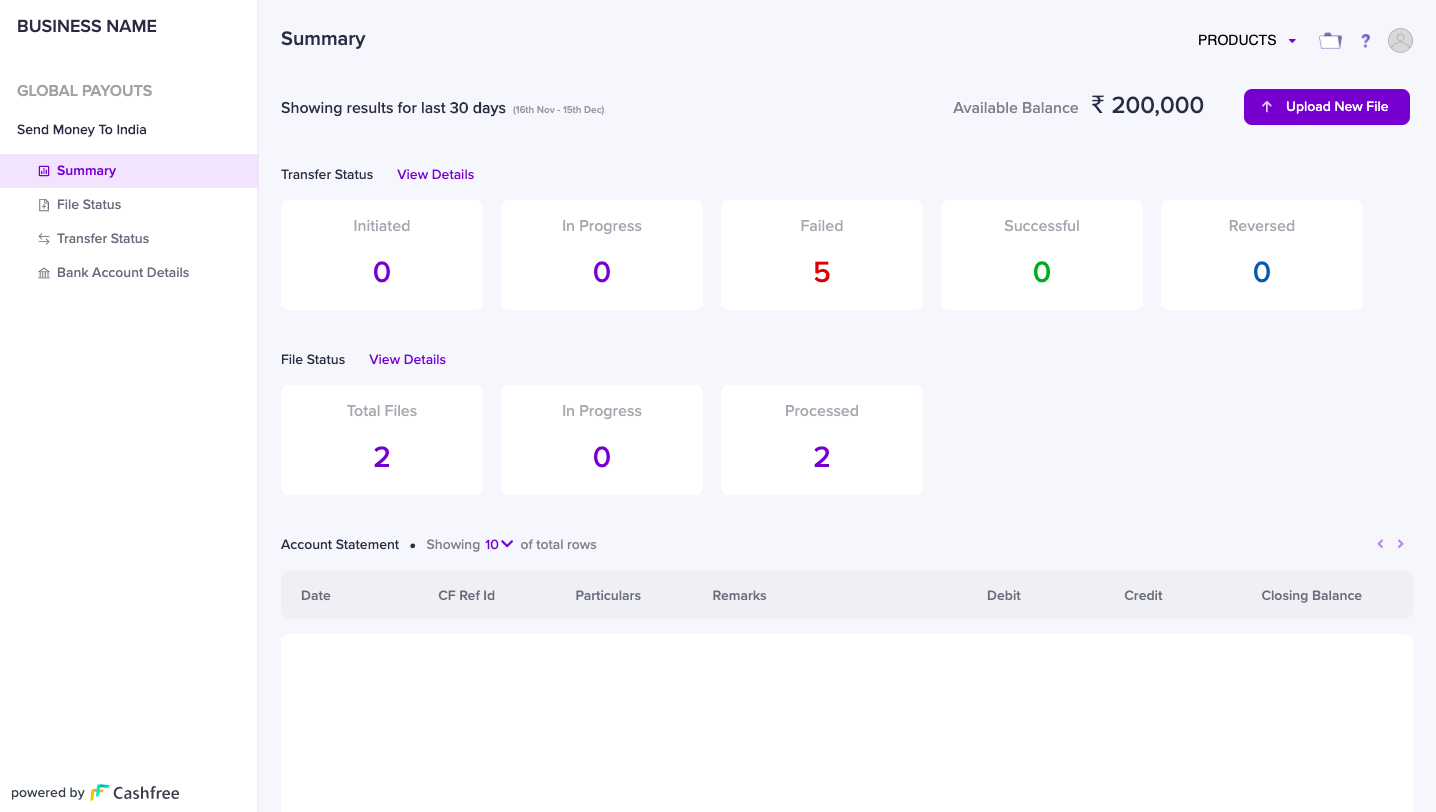

Summary

The summary page provides useful insights into your Global Payouts account. It gives you a quick view of the available balance, recent file statuses, transfers statuses, and account statements at a glance.

Click Upload New File to initiate payouts to your beneficiary.

Summary

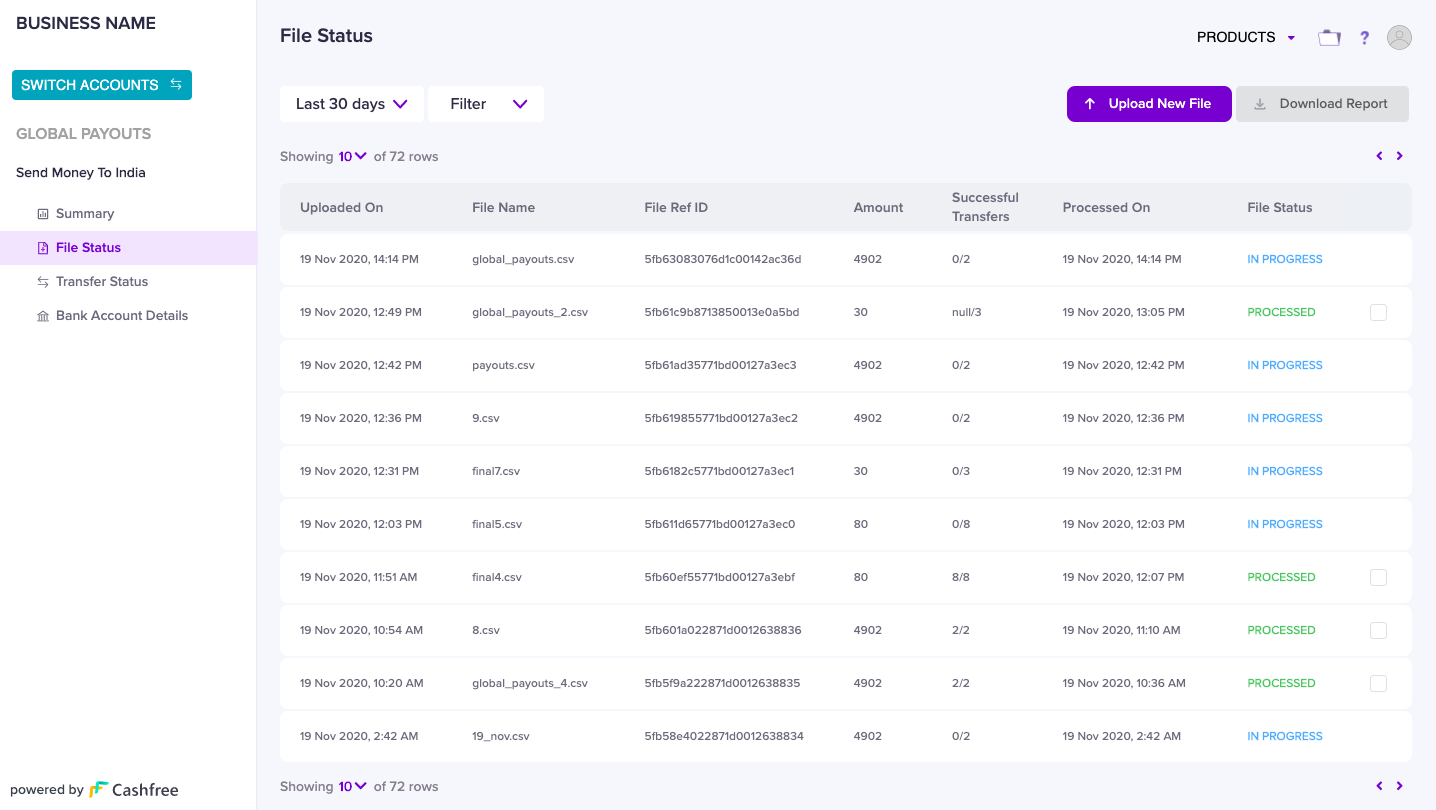

File Status

The file status section lists all the successfully uploaded files and provides you with information about the status of your requested file. You can also use this section to gain insights on the number of successful payouts or download the file status reports. The section also allows you to click a row entry and provides the detailed status of transfers uploaded in that file.

File Status

File Status Report

The file status report provides you with the details of all the transfers that were made in the uploaded file. Beneficiary details, payment reference number, transfer status, rejection reasons and more, is available in the report. The reports are available to download once the file has transitioned to Processed status.

To generate the transfers report,

- Go to Global Payouts - Send Money to India Dashboard > File Status section.

- Select the checkbox for the desired file status reports.

- Click Download.

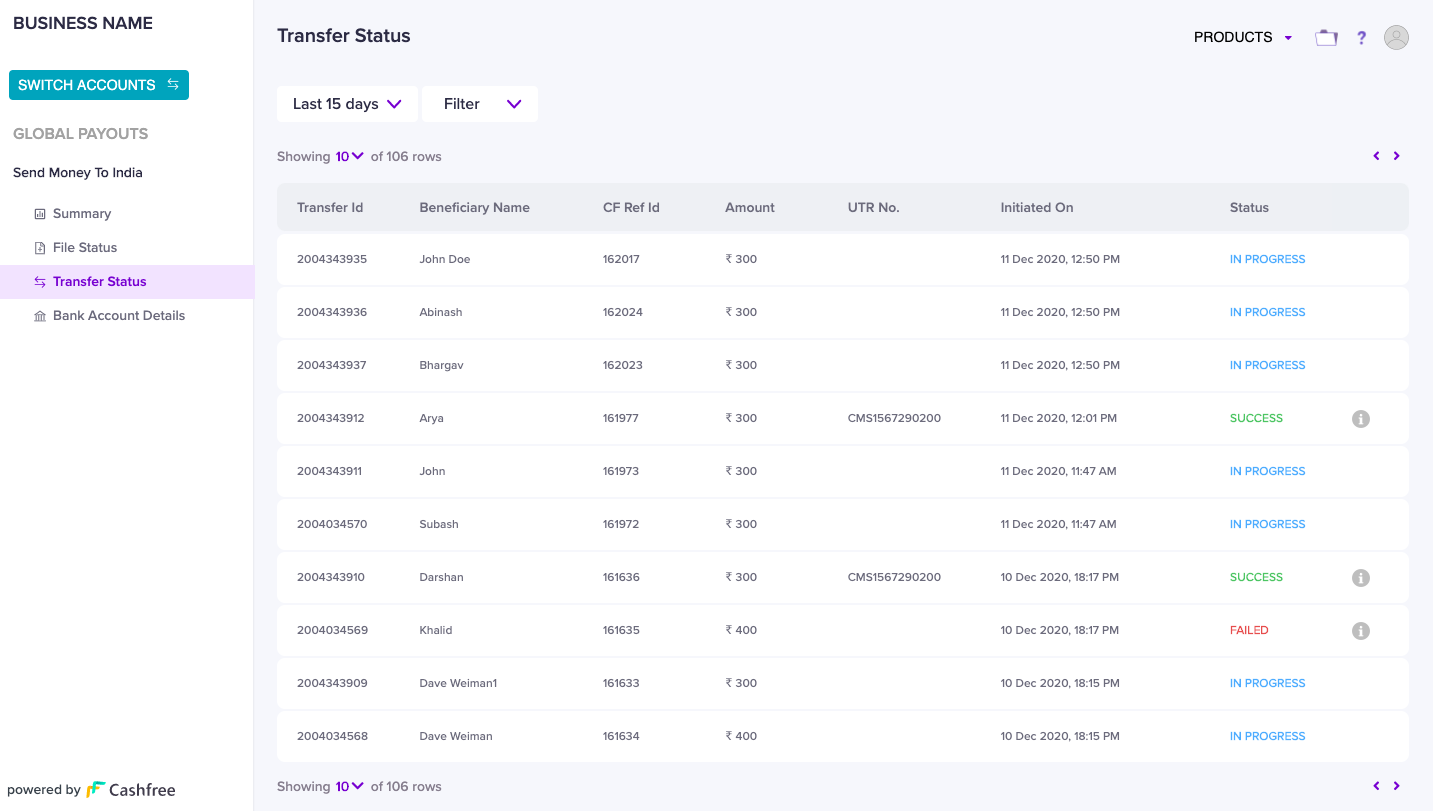

Transfer Status

The Transfer Status section lists all the transfers that were initiated via the file upload and provides you with the status of each transfer. The status gets updated as per the Transfer Lifecycle.

Transfer Status

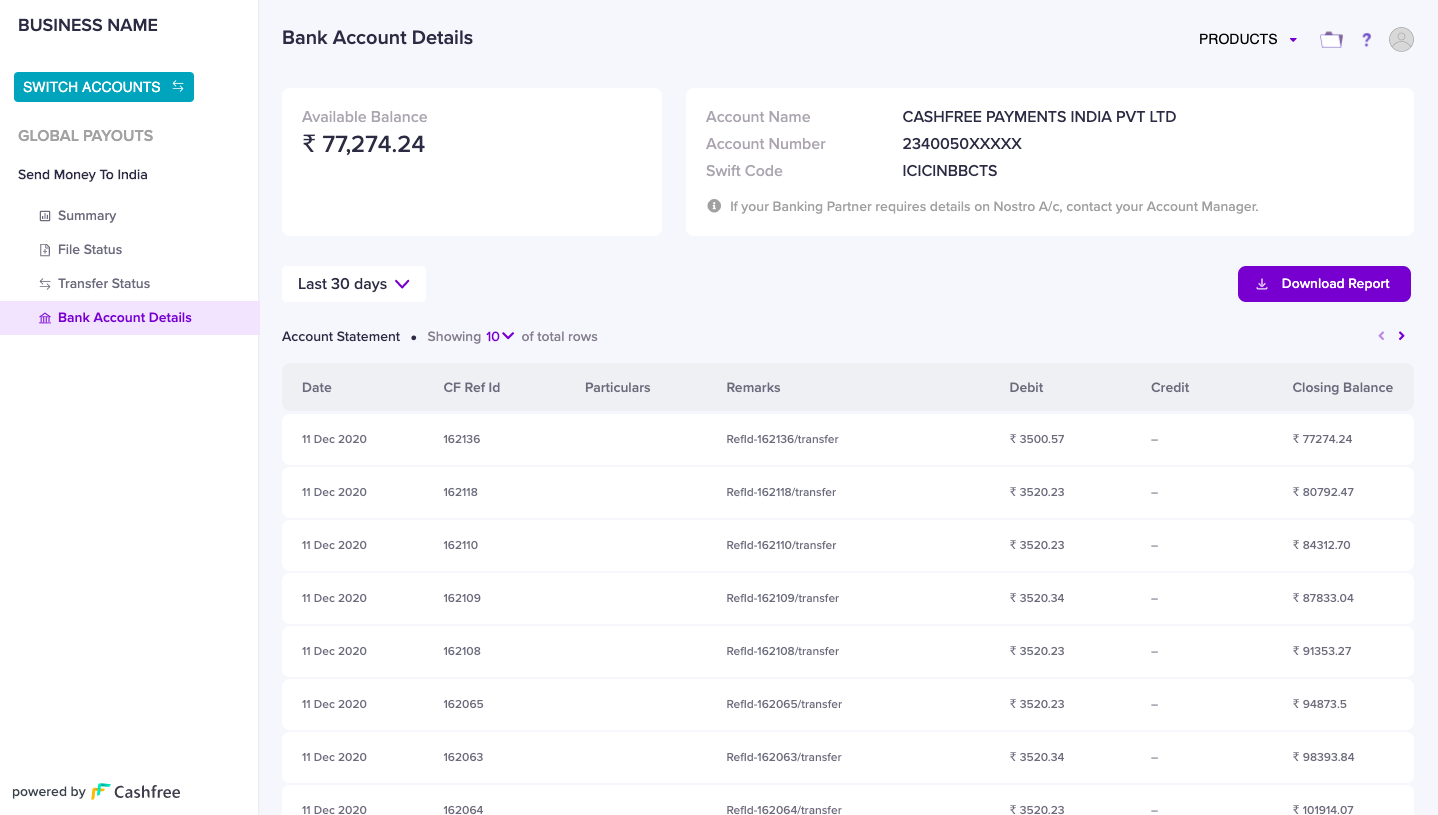

Bank Account Details

The Bank Account Details section provides your Recharge Account related details. You can view your available balance in INR, download your account statements or view your recharge accounts details.

Bank Account Details

Account Statement

The account statement report provides a summary of all debits and credits that have happened in your account for the selected time period and helps you in reconciliation. The statement will be sent to your registered email address.

To view your account statement,

- Go to Global Payouts - Send Money to India Dashboard > Bank Account Details section.

- Specify the date range.

- Click Download.

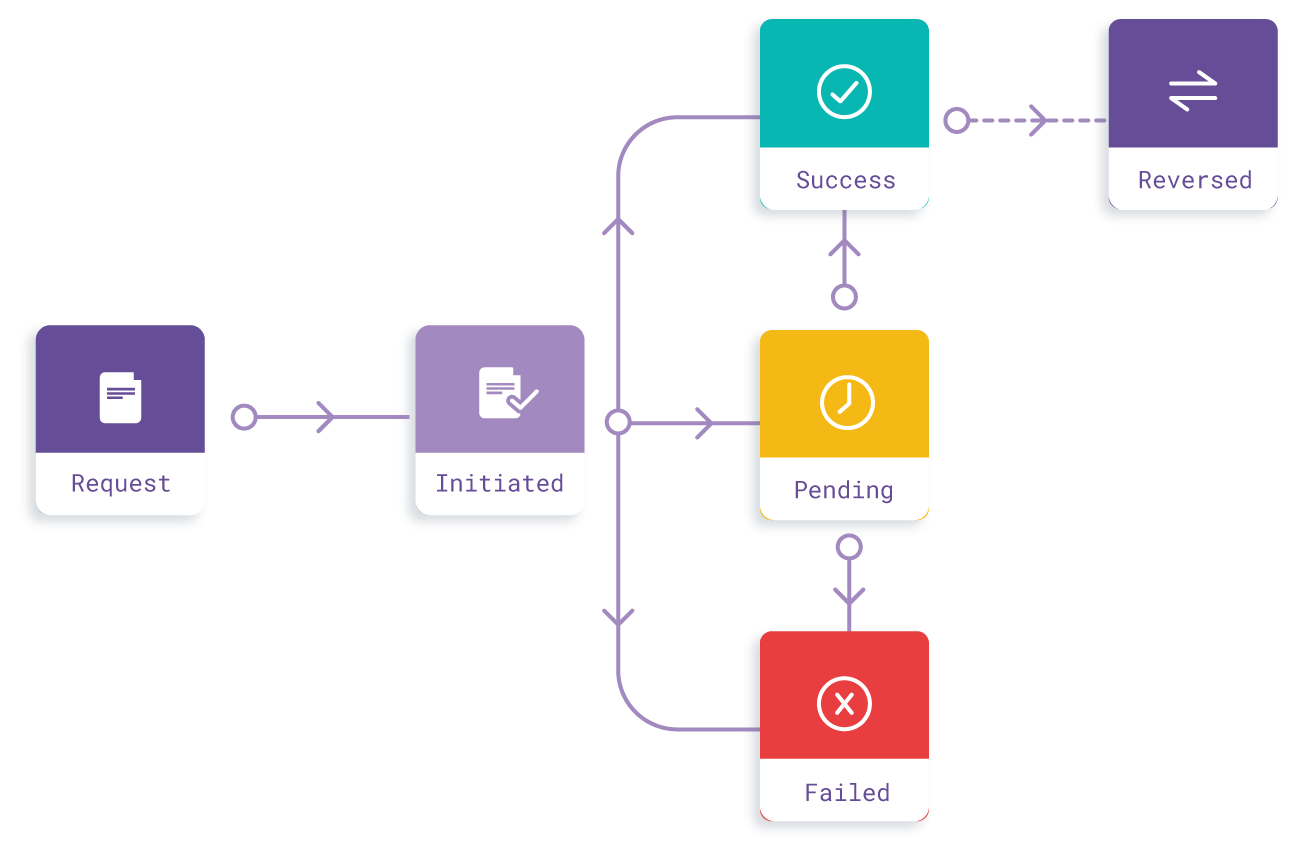

Transfer Lifecycle

Cashfree Global Payouts - Send Money to India supports asynchronous payouts lifecycle. In an asynchronous lifecycle, the user immediately receives a confirmation of the file receipt and the transfer processing is initiated. The terminal status of the transfer is updated on the dashboard after the request has been processed with our banking partners.

Transfer Lifecycle

Initiated

When a transfer request has been received, the payout is in the Initiated state. This status is an acknowledgement of request receipt at Cashfree and the payout is yet to be processed with our banking partners.

In Progress

When the transfer request is under processing with our banking partners, the payout transitions to an In Progress state. At this point, no further action is required from your end.

Failed

When the transfer request fails, the payout reflects the Failed state. It is the final state and does not allow transitioning to any other state. A payout can indicate the Failed state due to various reasons, such as:

- The beneficiary account details are entered incorrectly.

- The partner banks flag transfers as a risk transaction during the AML validation.

- There is an insufficient balance in your recharge account.

Success

When our partner banks have successfully processed the payout request to your beneficiaries, the payout transitions to the Success state.

The Success state can transition into the Reversed state if the transfer is returned by the beneficiary bank.

Reversed

When the beneficiary bank reverses a transfer request to our partner banks, the state of the payout transitions from Success to Reversed. It is the final state and does not transition to any other state further. The payout amount is credited to your recharge account.

A few common reasons for beneficiary banks to return a transfer are listed below:

- Incorrect account details.

- Beneficiaries account is temporarily suspended or blocked.

- Reversal by the beneficiary bank due to technical reasons.

File Parameters

| Fields | Mandatory/Optional | Type | Description |

|---|---|---|---|

| Transaction Reference ID | Mandatory | String | The reference ID of the transaction. |

| Beneficiary Bank Name | Mandatory | String | Beneficiary’s bank name to which the Payout is being made. |

| Beneficiary Branch IFSC | Mandatory | String | Beneficiary branch IFSC should contain 11 characters, 5th character is 0 (zero). |

| Beneficiary Customer Account Type | Mandatory | String | Beneficiary account type - “Savings” or “Current”. |

| Beneficiary Customer Account No | Mandatory | String | If the beneficiary account number is prefixed with zeros, include it as it is. |

| Beneficiary Customer Account Name | Mandatory | String | Beneficiary name should be as per the bank records. |

| Sender to Receiver Information | Optional | String | Provide remarks to the receiver. |

| Beneficiary Email ID | Mandatory | String | Beneficiary email, string in email Id format (Ex: [email protected]) - should contain @ and dot (.). Character limit is 200. |

| Beneficiary Address | Mandatory | String | Beneficiaries address, alphanumeric and space allowed. |

| Name of Remitter | Mandatory | String | Name of the remitter should be inline with the buyer's name in the invoice. |

| Address of Remitter | Mandatory | String | Address of the remitter should be inline with the address in the invoice. |

| Amount USD | Mandatory | Number | A maximum of 10,000 USD per transaction is allowed. |

| Amount INR | Mandatory | Number | Amount to be transferred (>= 1.00) Two decimal places are allowed. |

| Type of Transaction | Mandatory | String | Type of transactions - Goods or Services. |

| PAN Number | Mandatory | String | Valid PAN of the beneficiary. PAN is a ten-character long alpha-numeric unique identifier. The first five characters are letters, followed by four numerals, and the last (tenth) character is a letter. |

| Country | Mandatory | String | Country of the remitter, inline with the invoice. |

| IEC | Optional | String | IEC stands for ‘Import and Exporter Code’. The 10 digit code is allotted by the Directorate General of Foreign Trade (DGFT). With an IEC, exporters can avail subsidiaries or otherwise as declared by Customs, Export Promotion Council or other authorities. |

| Purpose Code | Mandatory | String | We support the purpose codes listed below. |

Purpose Codes

Purpose Code is a code issued by the Reserve Bank of India (RBI) to classify the nature of foreign currency transactions. Purpose code helps in identifying the exact nature of a cross-border transaction. Before initiating a payout to any recipient, you must select the code which is closest to your beneficiary offering.

| Purpose Code | Type of Transaction | Description |

|---|---|---|

| P0103 | Goods | Advance receipts against export contracts, which will be covered later by GR/PP/SOFTEX/SDF – other than Nepal and Bhutan. |

| P0802 | Services | Software consultancy/implementation (other than those covered in SOFTEX form). |

| P1002 | Services | Trade-related services - Commission on exports/imports. |

| P1004 | Services | Legal services. |

| P1005 | Services | Accounting, auditing, bookkeeping services. |

| P1006 | Services | Business and management consultancy and public relations services. |

| P1007 | Services | Advertising, trade fair service. |

| P1008 | Services | Research & Development services. |

| P1009 | Services | Architectural services. |

| P1020 | Services | Wholesale and retailing trade services. |

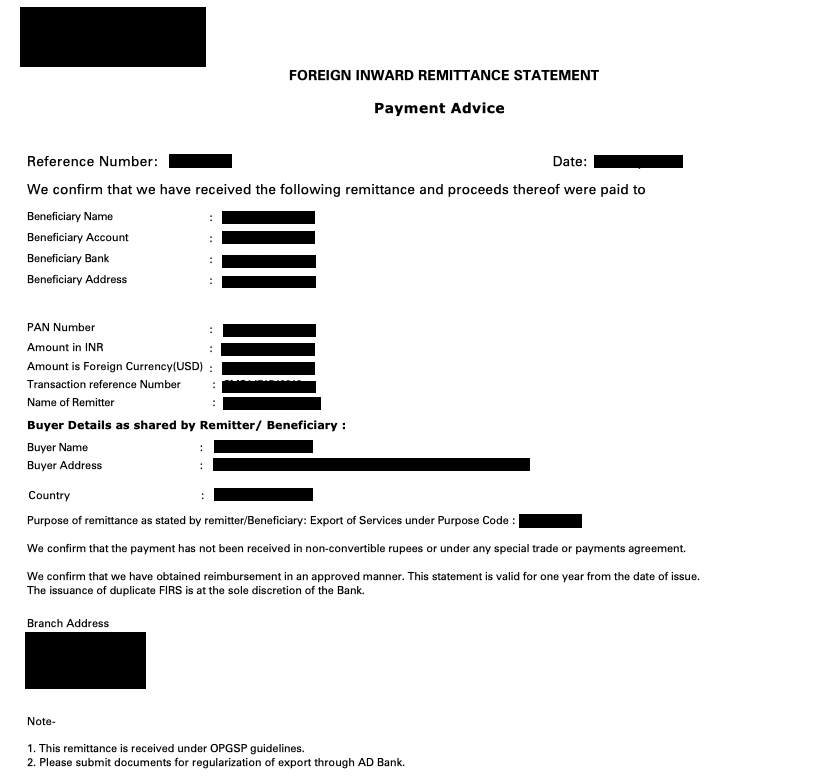

Remittance Statement

Our banking partners will send the payment statement e-copy directly to the beneficiary’s email address specified in the file on the same day as the transfer.

Why is this required?

Foreign Inward Remittance Statement (FIRS) is a document that serves as proof of a foreign transfer to India. Basis the FIRS details, the beneficiary bank issues a FIRC (Foreign Inward Remittance Certificate) and BRC (Bank Regularisation Certificate) which is required as proof at DGFT (Directorate General of Foreign Trade) and other agencies like Customs department.

Cashfree’s partner banks issue FIRS copy against each payout. The copy is sent to the registered email ID of the beneficiary.

Remittance Statement

Updated about 1 year ago