BaaS Prepaid Card Issuance

Cashfree Payments facilitates the issuance of prepaid cards to your customers. These cards are instruments with monetary value that enable your customers to purchase goods and services, withdraw cash, and perform other financial services.

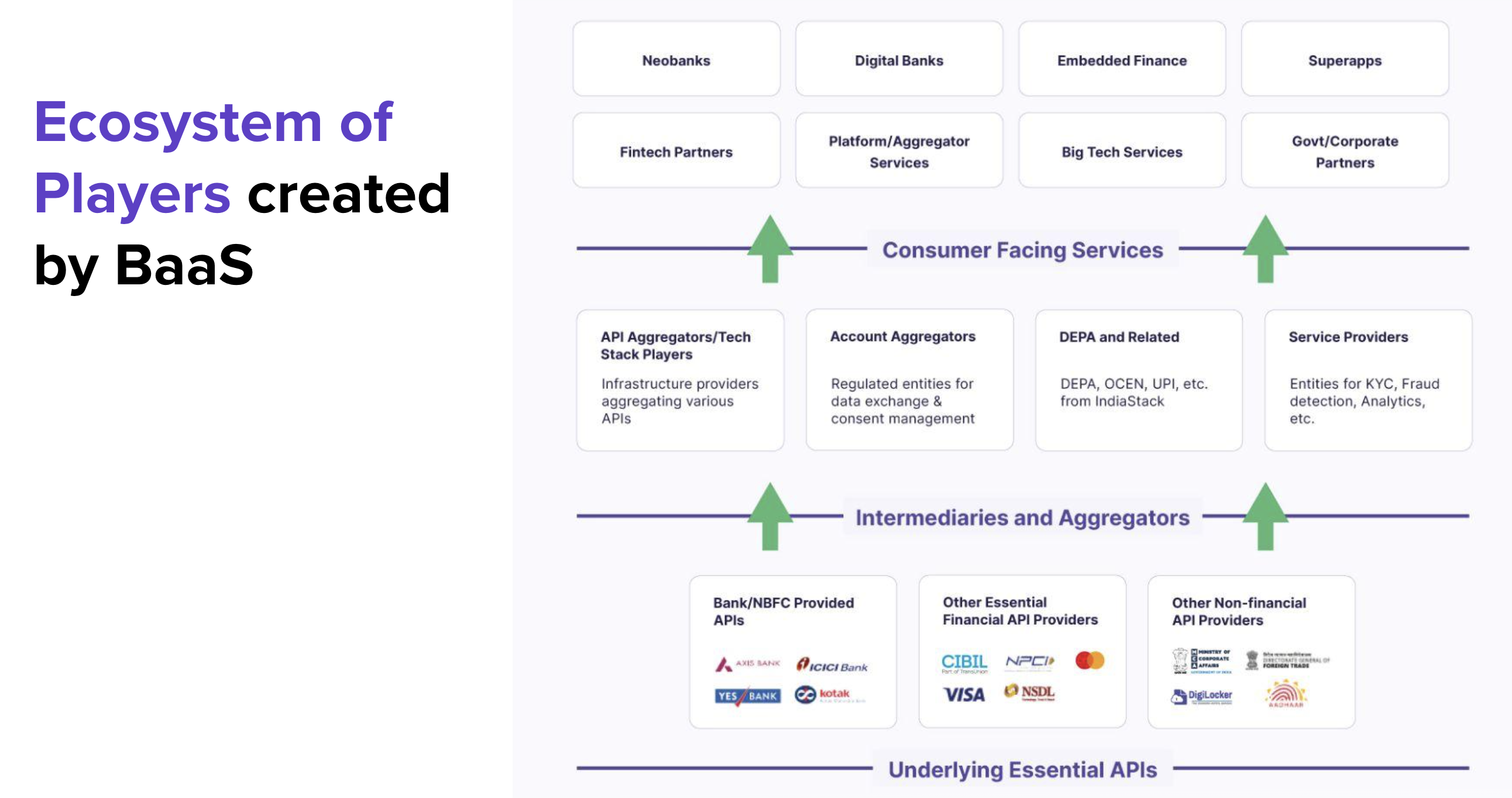

Banking as a Service(Baas)

BaaS is the facilitation of banking products and services by third-party service providers. These services are now directly accessible to customers via BaaS merchants.

Players Ecosystem created by BaaS

Prepaid Payment Instruments

Cashfree Payments provides an end-to-end solution for PPI card issuance, starting from setting up the program, onboarding customers, and also issuing cards based on minimum and full KYC verification. Businesses can use either the dashboard dedicated for prepaid cards or the PPI card issuing API stack for various card-related operations.

Cashfree Payments allows you to issue prepaid cards to your customers. A prepaid card is a payment card with monetary value. You can recharge, manage, and customise according to your preferences. Your customers can pay for things or withdraw cash based on the credit limit. Offer a safer mode of transaction for your customers with prepaid cards. Practice cashless financial transaction in your organisation. By default, virtual cards are issued. Contact your account manager to request a physical card for your customers.

Reach out to your account manager to enable the prepaid cards feature for your business needs.

Prepaid Card Benefits

You can issue a prepaid card to your customers as a gift card or loyalty card; it helps with expense management, neo-banking etc. Our PPI card issuing stack provides a program for both open and closed loops. Issuing prepaid cards to your customers can benefit your business in multiple ways.

- Better brand visibility - Customise and co-brand the prepaid cards to increase market strength, brand awareness, and credibility. Keep your customers engaged, reach out to more customers, and improve your customer loyalty with these prepaid cards.

- Visibility and control - Have control over the issued prepaid cards and visibility over their status.

- Secure and reliable - Enable expenses, salary disbursals, credit, and other use cases in a secure & reliable set-up. Offer your customers a safer and easier mode of transactions

- Flexibility - Choose between physical or digital cards to issue for your customers. You can also opt for both.

- Streamlined dashboard - Manage the issued prepaid cards in an easy-to-use dashboard. Easily block or unblock an issued prepaid card.

Customise Card Program

Merchants can integrate with our PPI card issuance stack for a hassle-free experience. We help you avoid multiple integrations with various parties like issuer, switch, network, and printing vendor. You need to finalise the following based on the card branding:

Mono-branded Cards

Mono-branded cards are branded on the name of the issuer.

| Network | RuPay, VISA |

| Issuing Entity | Livquik |

| Card Type | Physical, Digital |

| Card Limit | Up to 2 lakhs |

| KYC Requirement | Min KYC, Full KYC |

| Transaction Type | POS, Cash withdrawal, Online transaction |

Co-branded Cards

Co-branded cards are branded on the name of the merchant and the issuer.

| Network | RuPay, VISA |

| Issuing Entity | Livquik |

| Card Type | Physical, Digital |

| Card Limit | Up to 2 lakhs |

| KYC Requirement | Min KYC, Full KYC |

| Transaction Type | POS, Cash withdrawal, Online transaction |

| Card Design |

The BIN is allocated for co-branded cards only after the approval of the program by the issuer. The merchant details are created on the Cashfree Payments dashboard. The dashboard gives complete visibility of the program where you can create new customers, issue cards, check the card status and available balance. The merchant can finalise the card and stationery designs for the program that enables customer onboarding.

APIs

You can use Cashfree Payments APIs to issue cards to your customers. Our flawless API keys streamline card operations and work efficiently. It quickly delivers your request to Cashfree Payments and sends the response back to your server. Contact your account manager to integrate with BaaS Prepaid Cards and issue prepaid payment instruments(PPI) to your customers.

The APIs involved are tabulated below with its descriptions.

| APIs | Descriptions |

|---|---|

| Create Customer | Use this API to create a customer who requires a prepaid payment instrument(PPI) card. |

| Generate OTP | Use this API to generate an OTP for customer verification. |

| Create Card | Use this API to create a card or instrument for your customer. |

| Get Instrument | Use this API to get the details of an issued card or instrument. |

| Get Instruments | Use this API to get the details of multiple cards or instruments issued to your customer. |

| Edit Card | Use this API to manage the card or instrument. You can terminate, block or unblock a card or instrument. |

| Get Balance | Use this API to view the balance of an issued card or instrument. |

| Get Statement | Use this API to view the statement or transactions of the issued card. |

| Set PIN | Use this API to enable your end users to set the PIN of their cards. The API receives an URL in the response parameter which the customer can use to set the PIN. |

| Get Card Details | Use this API to get the complete details of an issued card or instrument. The API receives an URL in the response parameter which the customer can use to view the card details. |

| Load Card | Use this API to recharge money for the issued card or instrument. |

| Get SDK Token | Use this API to make the card details visible on your website or app for your customers. |

End Points

| Environment | Base URL |

|---|---|

| Production | https://api.cashfree.com/banking |

| Test | https://test.cashfree.com/banking |

Dashboard

Manage the issued prepaid cards in an easy-to-use dashboard. The instrument details are created on the Cashfree Payments dashboard. The dashboard gives complete visibility of the program where you can create new customers, issue cards, easily block or unblock issued prepaid cards, check the card status and available balance. You can finalise the card and stationery designs for the program that enables customer onboarding.

The following articles cover the dashboard functionalities that you can perform:

Prepaid Card FAQ

1. What is a prepaid card?

A prepaid card is a payment card with monetary value.

2. How do I request for a physical prepaid card?

Contact your account manager to request a physical card for your customers.

3. What are the available prepaid card types?

Physical and digital card types are available.

4. Can I co-brand the prepaid cards?

Yes, you can co-brand the prepaid cards to increase market strength, brand awareness, and credibility.

5. How can I transfer money to the customer’s prepaid card?

Quickly recharge a prepaid card using the dashboard when the card runs low on money. In the Load Card popup, enter the following information:

Transaction ID - Enter the transaction ID in this field.

Amount - Enter the amount you wish to load in the prepaid card in this field.

6. When should I block a prepaid card?

Block a prepaid card when it is misplaced or stolen and when you don't want your cardholder to spend the available money.

7. Can prepaid cards be used anywhere?

The end customer can transact on different platforms using various payment modes like POS, cash withdrawal, and online transactions.

Updated about 1 year ago