Flash UPI

In this section, you will learn in detail about Flash UPI - a seamless in-app UPI payment method.

Flash UPI is a mobile SDK that is designed to help businesses operating via mobile applications to accept ‘in-app’ UPI payments. Customers can make UPI payments within the business application itself, without needing to interact with a third-party UPI application to complete the payment.

Advantages

- The Fastest Checkout in India ever: Accept payments in a flash (<5 seconds!) providing unmatched speed and convenience for your customers.

- Higher Success Rate by 6-8%: By reducing the number of opportunities for customers to drop off during the payment process, you can achieve a higher success rate, ultimately boosting your revenue and bottom line.

- Control Over Your Customer's Payment Journey: Your customers never leave your app, allowing you to maintain complete control over their payment journey.

- Achieve a Faster Time-to-Market: Flash UPI SDK allows you to accelerate your time-to-market by simplifying the integration process with extensive documentation and expert support.

Use Cases

- Cab aggregators or transportation services

Reduce the transaction friction and make it easier for customers to book and ride seamlessly with a payment experience that’s as fast and convenient as your brand. - E-commerce

Don’t let your customer reconsider - use offers with direct embedded UPI payments to increase conversions and drive customer delight and retention. - Food Delivery

Your customers can select Flash UPI to make instant payments for food delivery without having to switch between different UPI applications. - Quick Commerce

Offer your customers an end-to-end experience that is as fast and as powerful as your riders and services. - Investment Platforms

Gain control over bank account selection, leading to reduced TPV failures and a seamless investment experience for users.

Watch the GIF below to see how Flash UPI works.

Flash UPI GIF

Flash UPI User Journey Flow

First Time User

These are the steps if your customer is using Flash UPI for the first time.

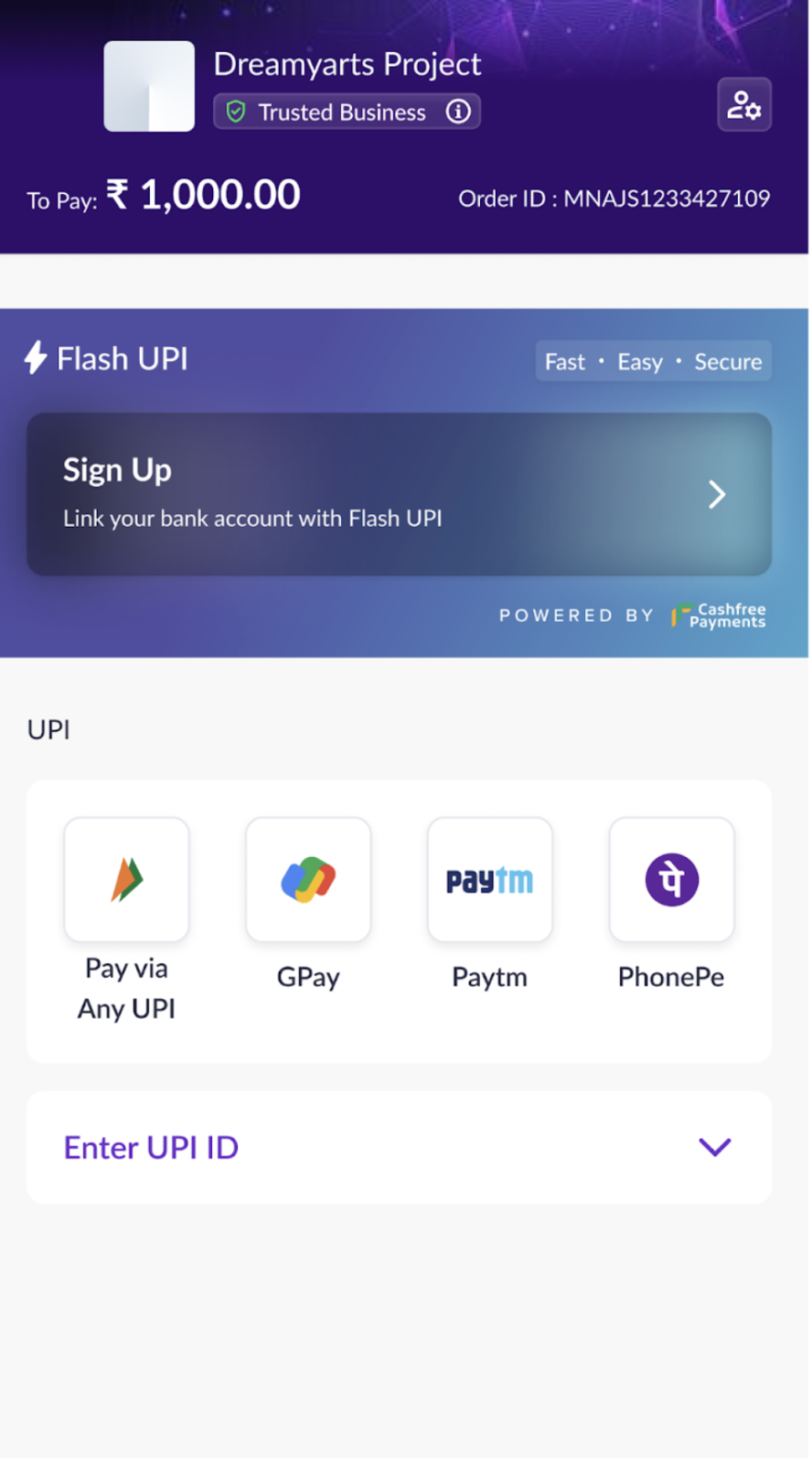

- Your customer lands on the merchant’s checkout page and selects the Sign Up option and adds the bank account with Flash UPI.

Sign Up

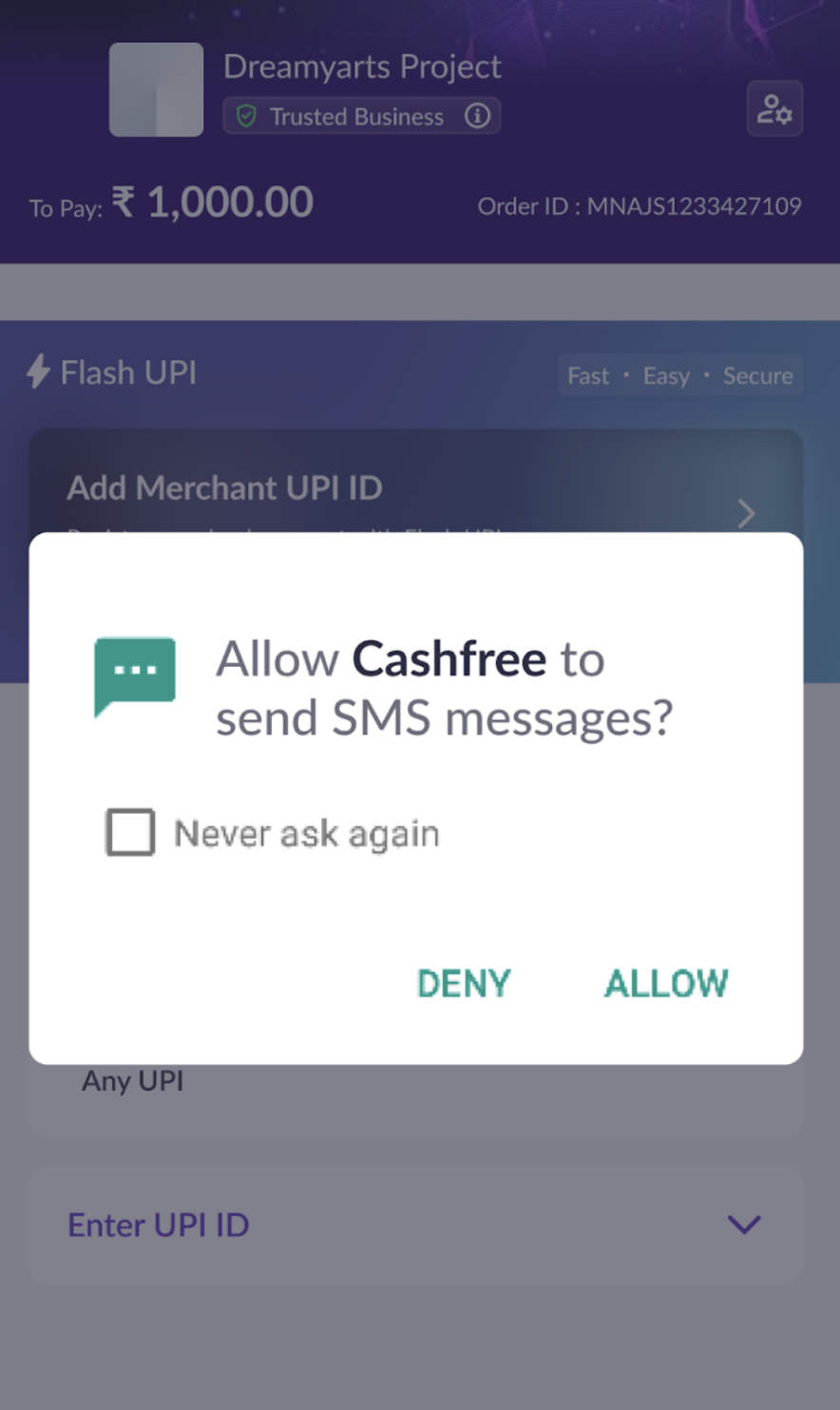

- The customer selects the SIM and gives permission to send text messages. This triggers device binding

SMS Permission

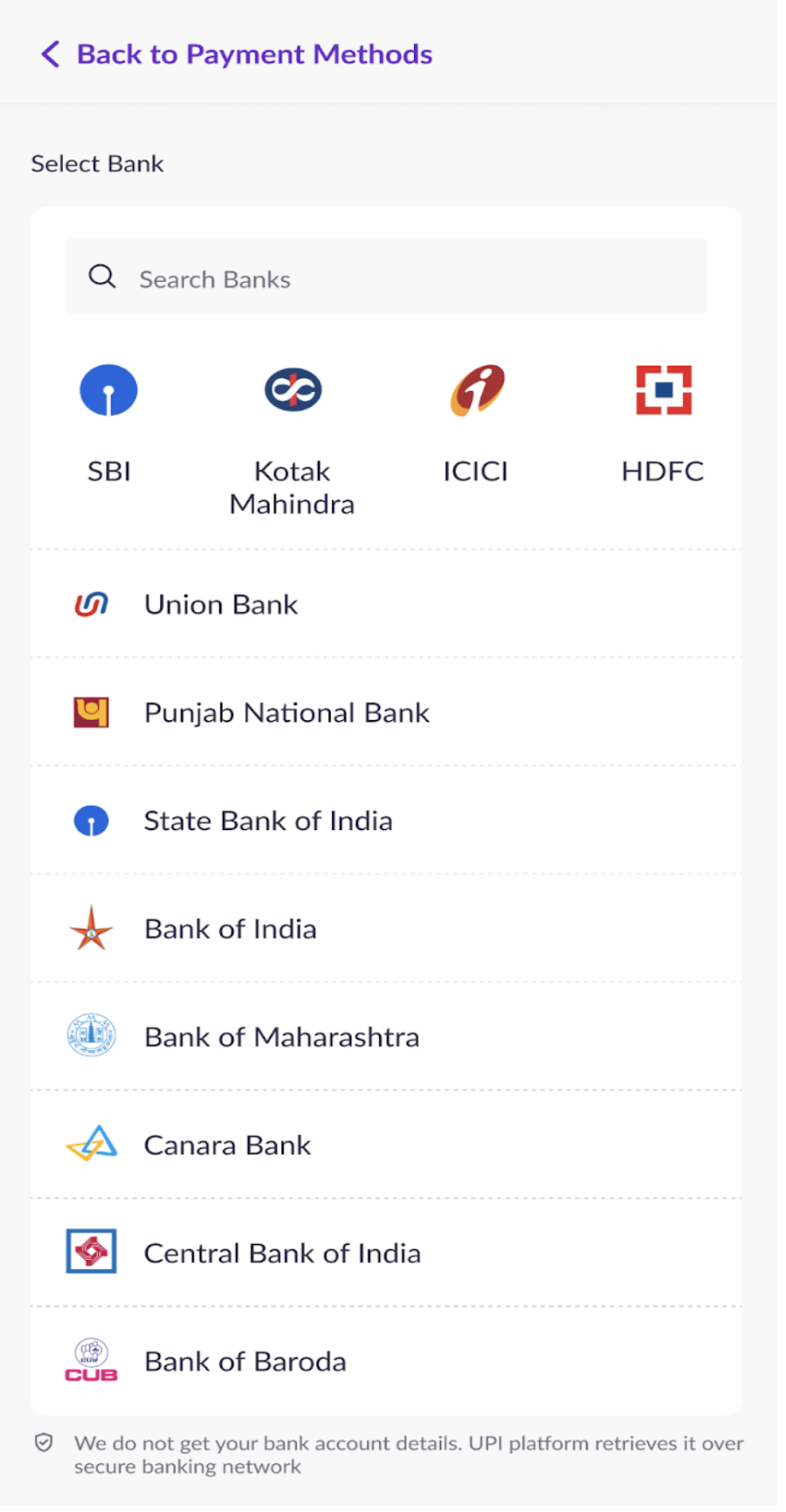

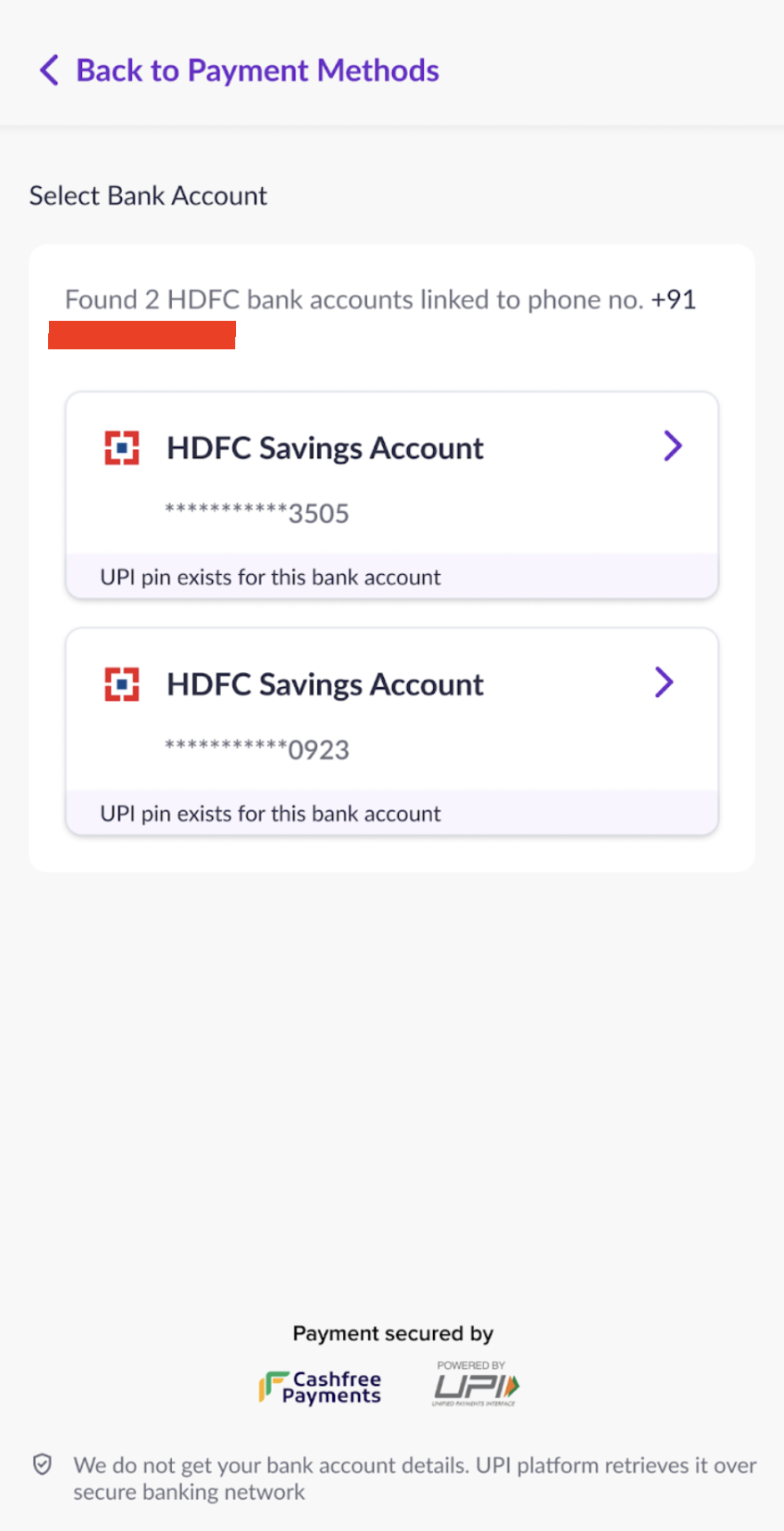

- If the customer has a VPA created with partner bank then the customer's bank account details are fetched. If not the customer selects bank whose account needs to be linked.

Select Bank

- All accounts associated with that bank are fetched.

All Accounts with that bank are shown

- We will create a new VPA and link accounts which has UPI PIN already set.

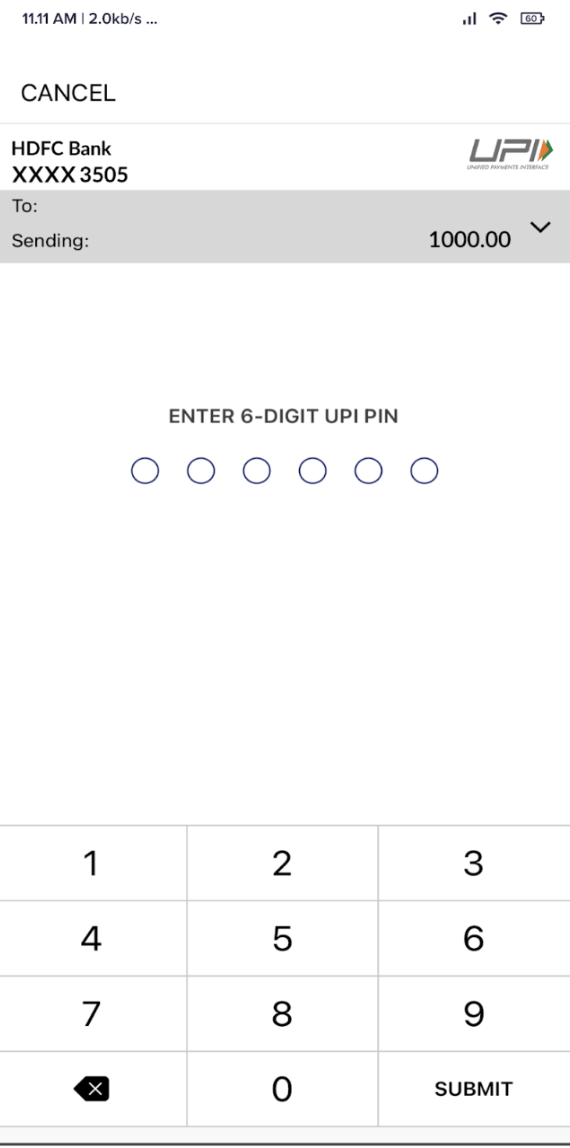

- If the customer has never used UPI, they are prompted to provide their card details, enter an OTP to complete the setup. Additional standard steps will be required such as entering card details and setting up the PIN. The customer enters UPI PIN to complete the payment.

Enter UPI PIN

Your customer can also do the following tasks from Flash UPI -

- Delete linked bank account

- Reset UPI PIN

- Change existing UPI PIN

- Check account balance

Registered User

These are the steps if your customer has already registered with Flash UPI.

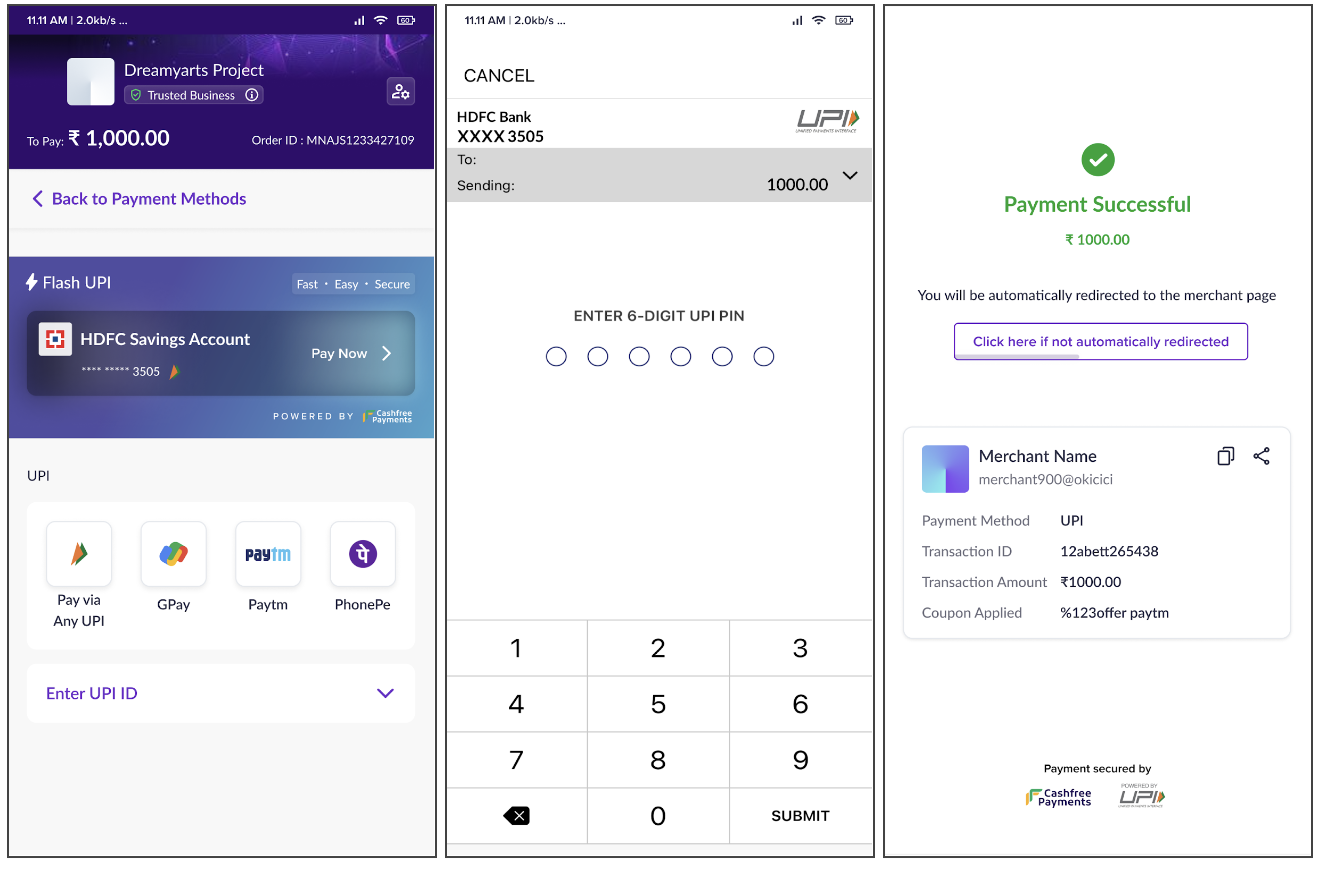

- Your customer lands on the merchant’s checkout page and selects Flash UPI.

- Customer enters UPI PIN and completes the payment.

Journey for Customer's who have enabled Flash UPI

| Pre Requisites |

|---|

| Data Localisation SAR Report |

| Compliance letter from empanelled auditor |

| Dependencies |

|---|

| appcompat, material, gson, okhttp, base, npci-commons-library, axis-olive-sdk |

| Permissions | Requesting SDK |

|---|---|

| READ_PHONE_STATE, READ_SMS, RECEIVE_SMS | NPCI SDK |

| ACCESS_FINE_LOCATION, ACCESS_COARSE_LOCATION, SEND_SMS | AXIS SDK |

Updated about 1 year ago