Dispute Actions

Learn in detail about the various scenarios involved in disputes.

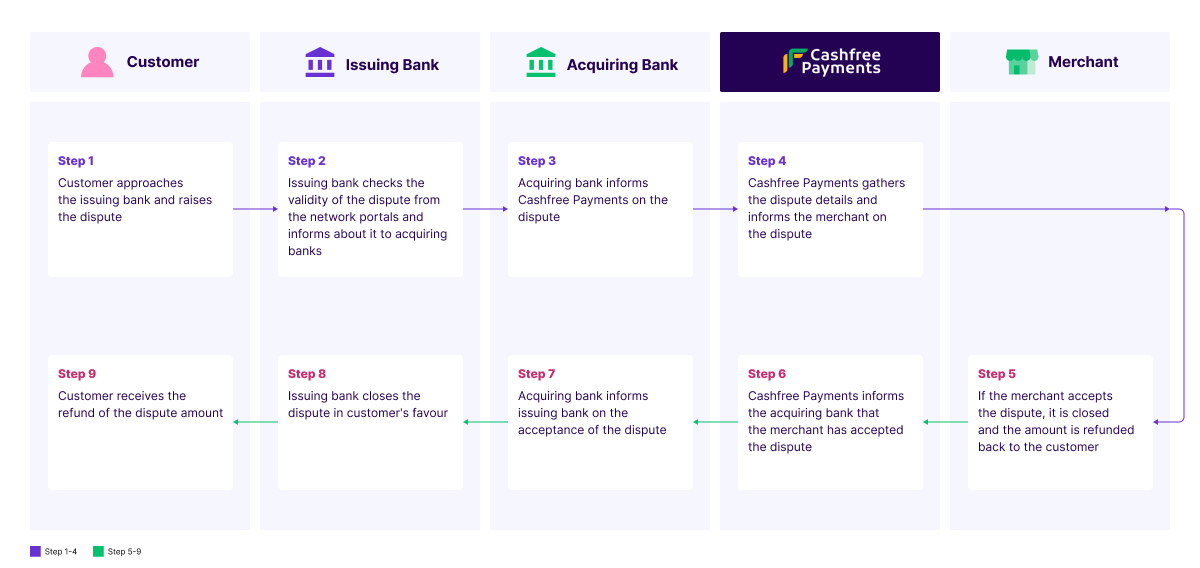

Scenario 1: Merchant accepts the dispute

Before you accept a dispute, have a clear understanding of why the dispute was raised. Check if the customer's claims are valid and if you have the required evidence to contest the dispute. If not you can proceed to accept the dispute.

If you accept a dispute and agree that it was a valid dispute raised by the customer, the amount will be refunded back to the customer’s account. This is sometimes the most appropriate option.

Scenario 1: Merchant accepts the dispute

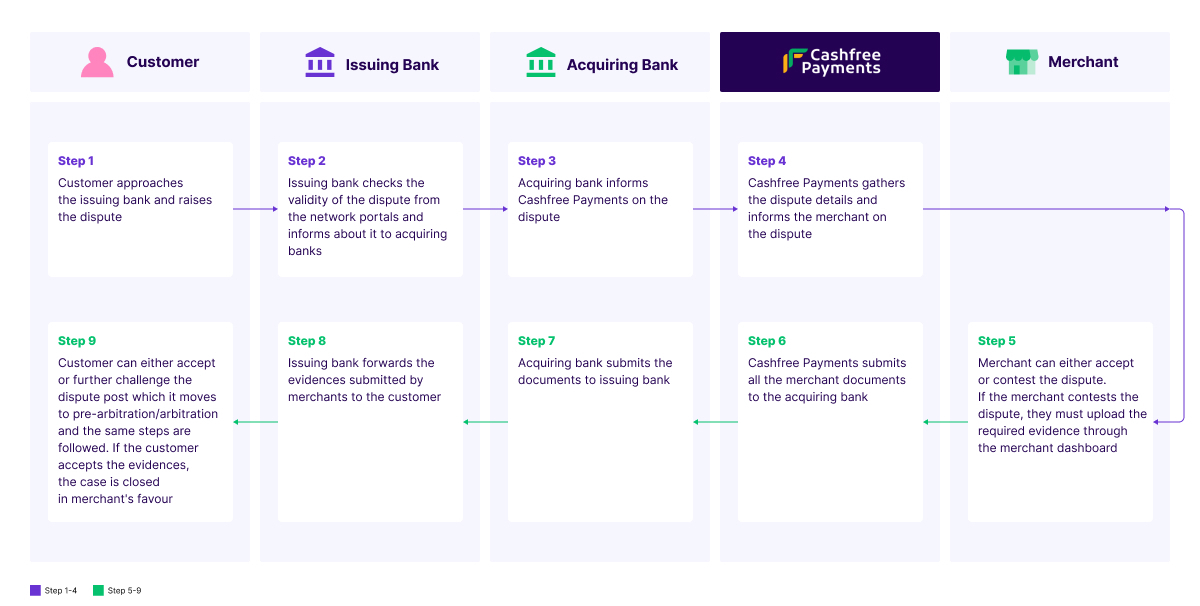

Scenario 2: Merchant contests the dispute

Once you have a clear idea of the reason why the dispute was raised, you can accept or challenge the dispute. In this scenario let us see the process involved during a challenge.

Keep the following points in mind before you decide to contest the dispute:

- Have the complete set of documents available with you before you upload the documents. Click here to learn more about the documents that are necessary during the upload process.

- All the documents are reviewed by the issuing bank, so ensure you upload valid documents.

- It is not necessary that you contest every dispute. As in some cases like pre-arbitration and arbitration, there is a high penalty involved.

- The entire dispute may take around 3 months time to conclude.

- If you don't provide any response you will lose the dispute and your customer will be refunded.

- Regularly check the dispute status from the merchant dashboard.

Scenario 2: Merchant Contests the dispute

Updated about 1 year ago