Introduction

You can access all the different verification tools, like, Bank Account Verification, PAN Verification, and UPI Verification under a single tab on the dashboard to instantly verify bank accounts, UPI VPA, IFSC, PAN, Aadhaar, and GSTIN details.

You can use it to verify beneficiary details during onboarding to ensure that the correct details are available to you for payments. You can also use this feature before making any payouts to ensure the successful transfer of funds to beneficiaries.

We do not support connected fund source accounts with respect to the Verification suite products.

Verify Bank Accounts, Aadhaar, PAN, and more for Free!

Use the Free Trial to verify your beneficiary details like bank accounts, UPI, PAN, and others at zero charges. With this limited-time offer, experience and test any Verification Suite feature without paying any verification charges.

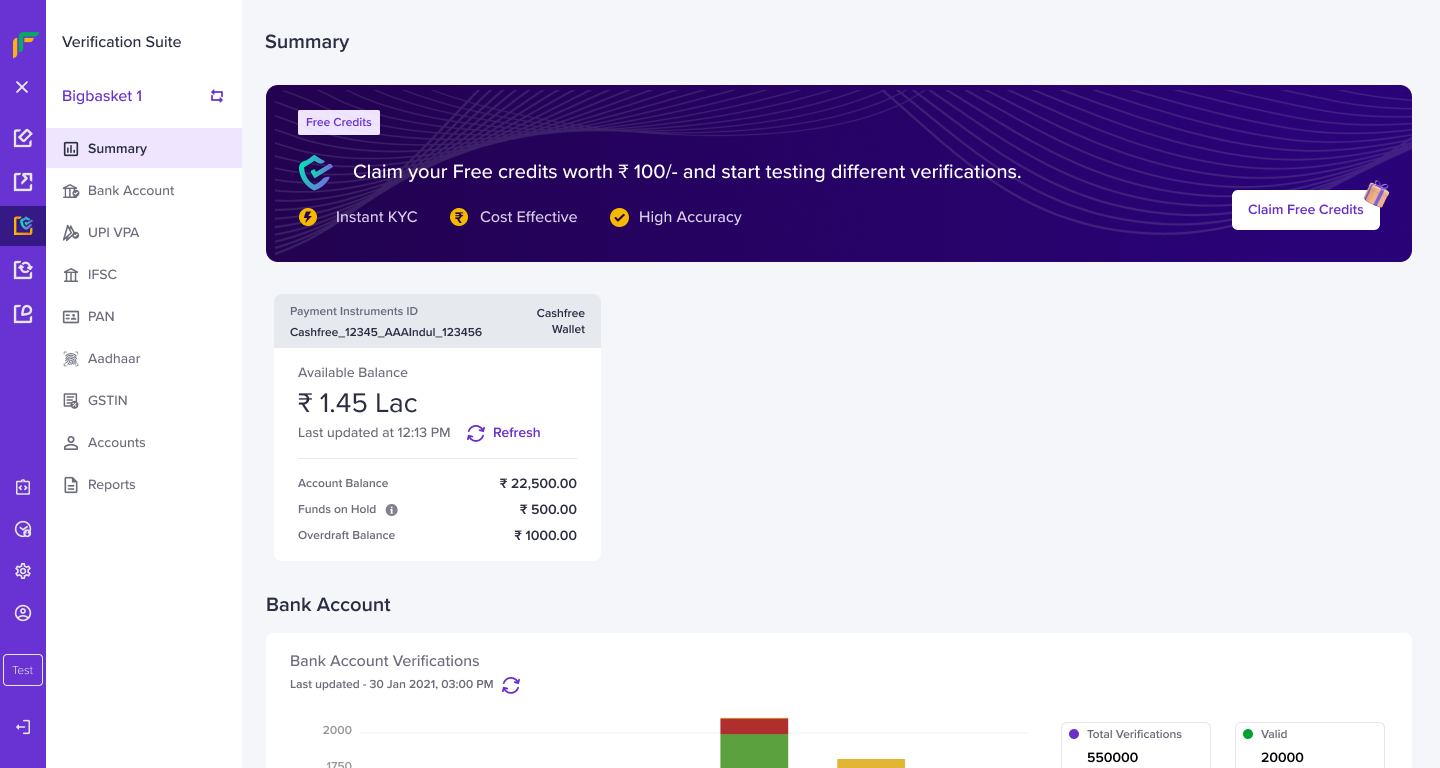

A banner displays the offer for you on the Summary page (Verification Suite Dashboard > Summary). Click Claim Free Credits and instantly redeem the credits to your account.

Free Credits

Verify beneficiary bank account details instantly and ensure that you have accurate details of your beneficiaries and make successful payments. Verifying the bank accounts ensures the transfers are successfully made to the correct beneficiary accounts.

Verify beneficiary UPI instantly using the UPI verification feature. You can verify a given customer name against the UPI or validate if the given UPI exists instantly with the UPI Verification feature.

Verify beneficiary bank IFSC instantly using Verification Suite. It also provides details like the bank and branch name, address, and supported payment modes. These details help businesses make successful transfers to the beneficiary.

PAN verification feature enables you to instantly verify PAN details of individuals or businesses before you onboard them or make any transactions with them. The feature helps you validate if a particular PAN is valid and check if it belongs to an individual or a business.

For sectors like securities and mutual funds, verifying beneficiary bank account details to process online payments may be mandatory.

Verify aadhaar details instantly of your customers before you onboard them. Aadhaar details are required during the customer onboarding process for various platforms like NBFCs, Banks, Lending companies, Insurance companies. Aadhaar verification is also an important part of the employee onboarding process for every business.

Verify GSTIN details of your customers instantly with the Cashfree Payments GSTIN Verification feature. This feature allows you to instantly verify GSTIN details of your customers for quick KYC, vendor onboarding, financing loans to businesses and insurance purposes.

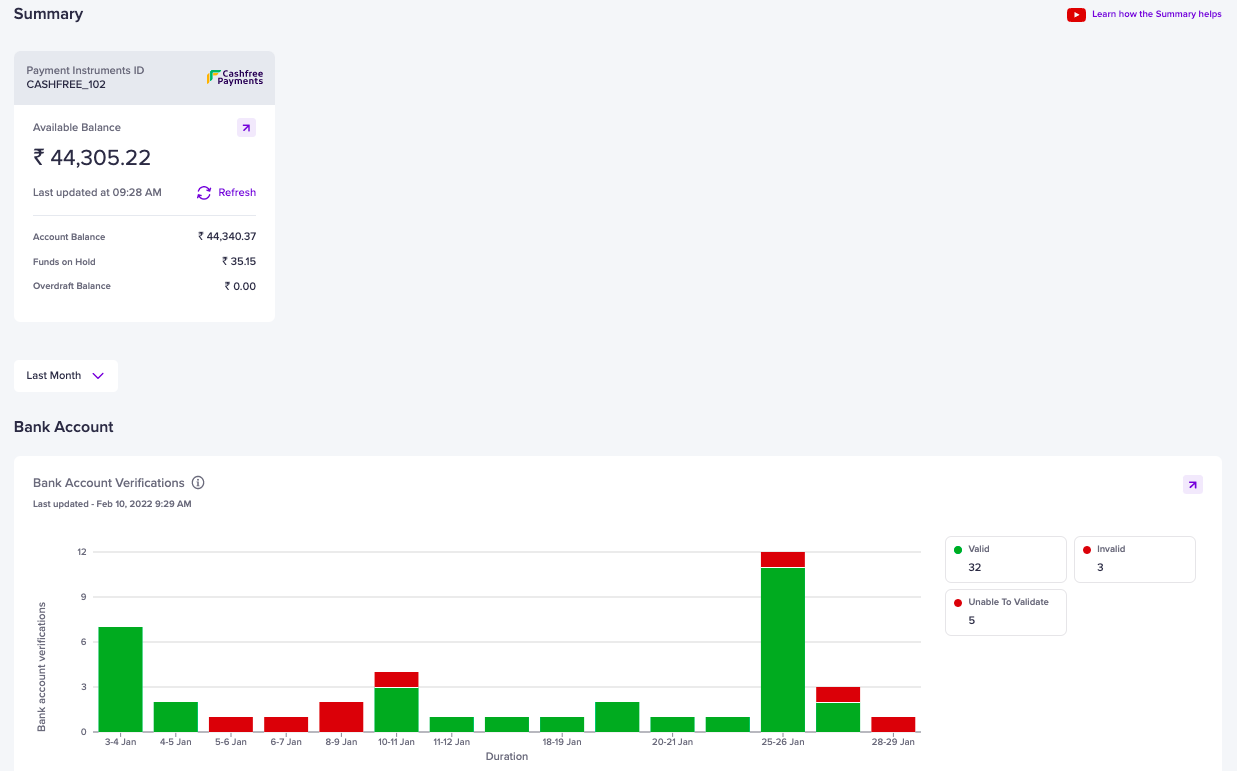

Summary

The summary section gives you an overview of the number of bank accounts, UPI VPAs, IFSC, PAN details, Aadhaar, and GSTIN you have verified. It also gives you a snapshot of how many details were valid and invalid. You can view the details for the current day, last 7 days, or any other custom date range. The balance available in your Cashfree Account is also shown here.

Verification Suite - Summary

Updated about 1 year ago