You can enable secure and controlled sharing of financial data between financial institutions and their customers with Cashfree Payments' Account Aggregator APIs. As the name suggests, they aggregate or collect financial data from various accounts held by an individual across different financial institutions. Here are a few key industries that can benefit from these APIs:

Industries benefiting from Account Aggregator APIs

- Lending

Banks, NBFCs, and fintech lenders can leverage these APIs to access comprehensive financial data for credit underwriting, risk assessment, and personalised loan offerings.

- Insurance

Insurance companies can use these APIs to assess risk profiles, offer customised insurance plans, and streamline claims processing.

- Wealth management

Firms that manage wealth can gain a holistic view of client's financial assets tp provide comprehensive financial planning and investment advice.

- Embedded finance

Fintechs can offer financial services directly to customers using Account Aggregator APIs.

- Healthcare

Healthcare providers can offer financial assistance programs and insurance-related services.

Account Aggregator APIs

Find the list of Account Aggregator APIs that Cashfree Payments offers:

| API | Description |

|---|---|

| Request Consent | Use this API to request consent from the individual to fetch the financial information. |

| Get Consent Status | Use this API to get the status of the consent request. |

| Request Financial Information | Use this API to request the financial information of the consented individual. |

| Fetch Financial Information | Use this API to fetch the financial information of the consented individual. |

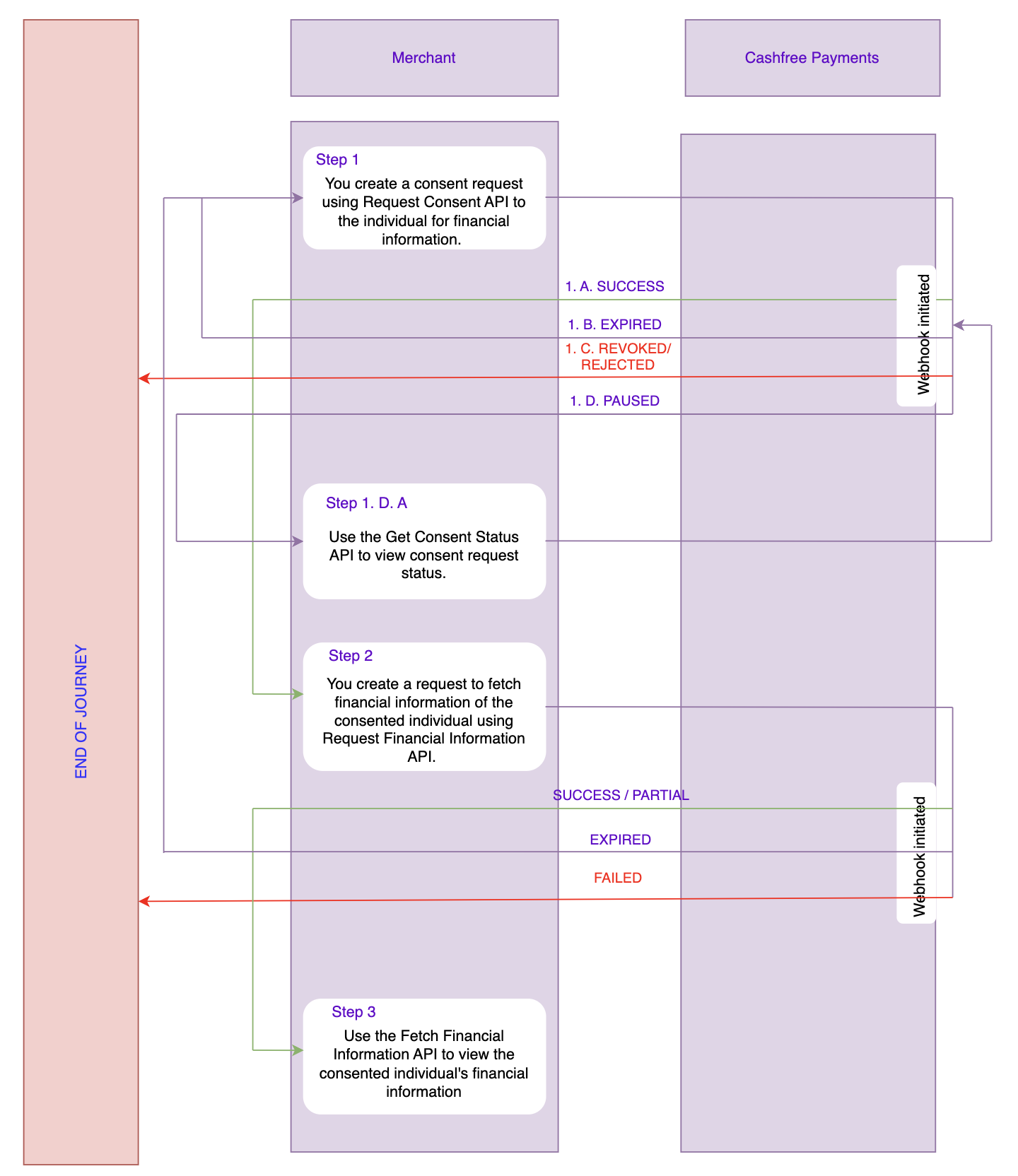

The following diagram helps you understand the journey of Account Aggregator APIs.

Account Aggregator API Journey

You can find more information on the webhook events that you receive during the journey.