Dispute Process Flow

Learn in detail about how the dispute process works in Cashfree Payments.

Parties Involved

There are several parties involved in a dispute. They are mentioned in the table below.

| Parties Involved | Description |

|---|---|

| Customer | The person who has availed your service and raised the dispute. |

| You (merchant) | The party whose goods/services are disputed. |

| Issuing Bank | The bank that issued the card to the customer. |

| Acquiring Bank | The bank that is tasked with acquiring the payment on your behalf. |

| Card Scheme | The card networks(Visa, Mastercard, Rupay, etc) and NPCI. |

| Payment Gateway | Cashfree Payments is the payment gateway that manages your transaction. |

Dispute Lifecycle

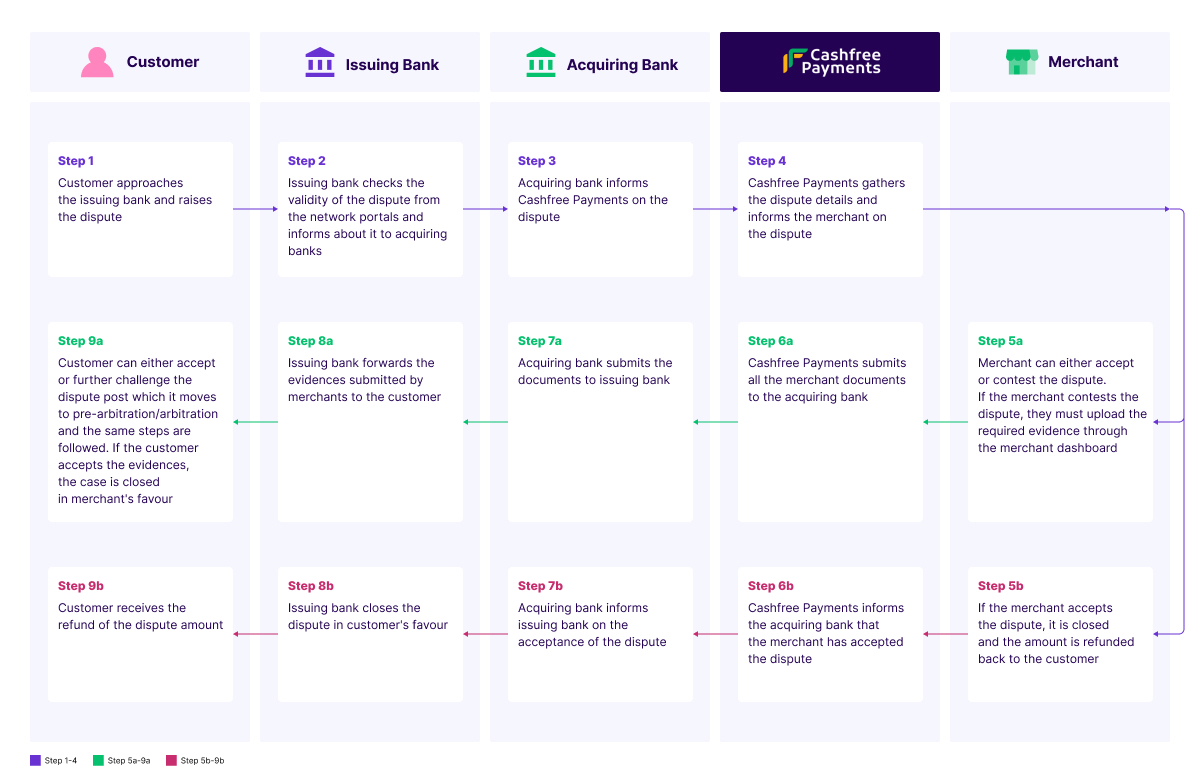

The image below depicts the dispute lifecycle.

Dispute Lifecycle

In the final stage of Chargeback i.e Arbitration the decision is taken by the card networks or NPCI considering the evidence submitted by both the parties (customer and merchant).

Stage 1: Dispute Received

The first stage in the dispute process is that the customer raises the dispute and you are informed of the dispute. The customer visits your website, searches for the required goods and pays for the product. The customer has an issue with the product and approaches their card issuer and files a dispute. The card issuer now gets in touch with the issuing bank (acquirer) and informs of the dispute.

The issuing bank contacts Cashfree Payments and informs us of the dispute. We then gather the required information and notify you about the dispute along with the reason provided by your customer. You are given a turnaround time and in the case of a chargeback, the verdict lies with the issuer bank.

Stage 2: Responding to the Dispute

Now that you have received the dispute, you have two options:

- Accept the dispute - If you find your customer's reason valid, you can accept the dispute and the amount will be refunded automatically to the customer's account. This is sometimes the most appropriate option. The dispute is closed in the customer's favour and the status is marked as Closed (Merchant Accepted). Click here to know what happens when you accept a dispute.

- Contest the dispute - If you feel that the customer has initiated a dispute wrongly, you can challenge the dispute. Ensure that you have the required documents before you contest the dispute. Click here to know more about what happens when you challenge a dispute.

Stage 3: Issuing Bank Gives Verdict

After submitting proof, the issuing bank reviews the documents you have shared with the customer. Your customer can revert back if they want to raise any further action. Post this the issuing bank makes a decision on the dispute.

Possible Outcomes:

- Dispute won - The dispute is closed in your favour and the status is marked as Closed (Merchant Won).

- Dispute lost - The dispute is closed in your customer's favour and the status is marked as Closed (Merchant Lost). The amount is refunded to your customer.

Updated 5 months ago